HAPPY 2015!

Illinois\’ New Year brings a host of new laws affecting individuals and families across the state. We reported on a few earlier, which you can if you scroll further down. However, this list is a brief review of what those of us in Illinois can celebrate and take note of: Illinois income tax decreases for individuals from 5% to 3.75% and for corporations from 7% to 5.25% House Bill 5686 modified probate rules for short-term minor guardianship A new tax force was created to asses the best way to govern Chicago Public Schools Cyberbullying rules now apply off school grounds Probate rules were strengthened for disabled adults The Child Care and Adoption Act was improved to recognize parties to civil unions, great-grandparents, step-parents, and cousins as family members

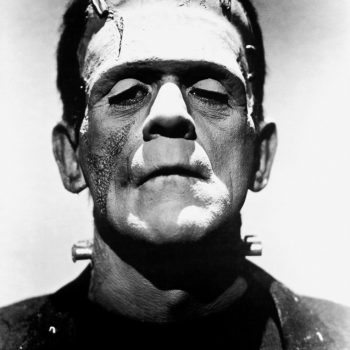

Unlike Frankenstein, This Legislative Change Is Real

On September 24, 2014, Illinois enacted changes to its Power of Attorney Act to “simplify” the healthcare power of attorney form. Estate planning attorneys have been watching this legislation wind its way through our system since it was proposed, hoping that it would die. The change went into effect on January 1, 2015. A few points to ponder and reasons why now, more than before, lawyers are needed to prepare advanced directives: 1. No standard form is required. So in medical emergencies, doctors must use their own judgment about a legal form. 2. The notice page that makes the form legal is FIVE PAGES long. 3. The form can be “included” or “combined” with the statutory property power of attorney. Do you really want your banker to know about your private health matters? 4. The changes remove actual provisions regarding choice of agent… OK…so that’s misleading – that guidance is somewhere in the FIVE PAGE notice. 5. The changes remove privacy language that reflects actual U.S. statutory privacy laws for medical practitioners and third parties. Happy Halloween…NOT! Read more here…

The Revised Small Estate Affidavit Still Helps Avoid Probate But Be Careful

The Small Estate Affidavit (SEA) was amended and went into effect on August 1, 2014. The SEA\’s purpose is to help heirs and beneficiaries of small estates – less than $100,000 in personal probate property (not real estate) – avoid probate, which cost thousands. Before the recent amendment, the affiant need only swear, upon penalty of perjury, that funeral expenses were paid or unpaid, name the funeral debtor, and name the heirs or beneficiaries of the estate. Now, the affiant must provide the name, address, and amount of all the decedents known unpaid debtors, who fall in the following categories: (1) Funeral and burial expenses, administration expenses; (2) surviving spouse or child\’s awards; (3) federal taxes or other debts due the U.S.; (4) certain monies due employees for services provided within a provided period; (5) money or property that is in trust but cannot be identified or traced; (6) debts due the state or any state municipality; and (7) all other claims. Moreover, these claims must be paid from the decedent\’s estate. Finally, unlike before the SEA now requires a notary. Given the addition of the claimants added to the SEA requirements, individuals using the Illinois Small Estate Affidavit must be very careful to ensure that all known debtors are listed because perjury is a felony.

State Retirees\’ Health Insurance Premiums Safe…for Now

On July 3, in Kanerva v. Weems, the Illinois Supreme Court ruled in favor of State’s retirees. The state challenged a 1992 amendment to the State Employees Group Insurance Act, requiring the state to pay, as a pension benefit, the health insurance premium for qualified retirees. The State argued that the rights were not protected under the Illinois State Constitution. The Illinois Supreme Court did, holding that the rights were protected per Article XIII, Section 5, which plainly states that “Membership in any pension or retirement system of the State, any unit of local government or school district, or any agency or instrumentality thereof, shall be an enforceable contractual relationship, the benefits of which shall not be diminished or impaired.” The costs associated with Illinois’ retirement system is wreaking havoc with our state’s credit rating. However, it seems that with this ruling, the State will likely have to find another way of streamlining costs or another source of income.

Paying the Price Twice for Long-Term \”Care\”

Most of us enjoy the benefit of the work, knowledge, and care provided by the generations who came before us. Yet, as the Silver Tsunami strikes, many in those generations are stricken with the inability to care for themselves and, often, enormous resources required to properly do so. For example, the average monthly nursing home bill in Illinois is $6,000. Even more heinous are the inequities in care with respect to seniors in various minority communities. To address these problems before they become insurmountable, the Illinois General Assembly passed a bill to create a Long-Term Services and Supports (LTSS) Disparities Task Force. Recent data shows a lower standard of care in long-term care services provided to minorities in Illinois. The task force’s goal is to close the gap on racial disparities and improve long-term care settings for all senior citizens. The main objective of the task force is to document information about the types of long-term care providers and the number and ethnic profiles of residents receiving services from these providers in or outside the home. Facilities monitored by the LTSS Disparities Task Force include: residential nursing facilities, assisted living facilities, and other home and community based long-term care services. The data will be used to analyze trends, identify racial disparities, and offer recommendations to eliminate inequalities and provide improved care. The Bill is now awaiting Governor Quinn’s signature. Read more here.

Balancing Your Checkbook Logically May Cost You

Pew Charitable Trusts recently released a report covering the consumer practices of many of the largest retail banks. The report showed that 50% of the banks don\’t allocate deposits the way most consumers balance their checkbooks – chronologically. Instead of allocating deposits chronologically or from smallest to highest payments, these banks do the opposite, causing the worst damage. The banks order transactions to be paid from the highest to the lowest. This increases the chances that their customers will experience overdrafts and, consequently, also increases the banks opportunity to collect NSF fees. Tap here to access the report. Until consumer protection laws make the ordering priority mandatory and more consumer-friendly, what can consumers do to prevent from incurring unwanted overdraft fees? Read your bank\’s disclosure rules that typically provides the bank\’s ordering process Change how you balance your checkbook and, consequently your budget, to match your bank\’s ordering process Opt out of overdraft coverage, so that purchases may be declined but you won\’t get hit with unnecessary fees