Changes in New York’s Power of Attorney

Changes in New York’s Power of Attorney By Max Elliott October 4, 2023 Author Gabrielle Wasenius Laws always evolve. Here at the Law Offices of Max Elliott, we stay current on estate planning, estate administration, and probate laws of the jurisdictions we serve. The laws related to the New York Power of Attorney (POA) underwent significant changes in 2021, bringing more flexibility for those preparing POAs and greater safeguards for those relying on them. One notable improvement is that the POA no longer requires an “exact wording” match but only wording that that “substantially conforms” to the statute. Previously, even minor typos or small mistakes could invalidate POAs. While the wording requirement changed, the fundamental rule that an agent’s powers are limited to those listed in the POA remains unchanged. However, the new law allows for more powers to be granted to agents, especially regarding gift-giving. Before the law changed, an agent could only make annual gifts of less than $500 unless the principal initialed a section of the POA to grant authority to the agent to make larger gifts and then also executed a separate Statutory Gifts Rider. The Statutory Gifts Rider had to be notarized and signed by 2 witnesses. These requirements were meant to combat fraud and abuse. But, requiring 2 forms created confusion. While POA forms properly executed under the law in effect at the time of their signing remain valid, the new POA law eliminates the Statutory Gifts Rider completely and allows for gifting provisions to be included in the POAs Modifications section. It also includes a standard provision allowing up to $5,000 in gifts per year, with the option to specify other amounts in the document itself, specifically in the Modifications section. This significantly simplifies the process. The new law also makes POAs easier to use. The law ensures that third parties like banks cannot reject a properly executed POA without good cause, and the statute provides a specific timeframe for them to do so. If they unreasonably refuse to recognize the agent’s authority, they may be held responsible for damages and reasonable attorney fees and costs by a court. The law also protects those who rely on POAs. The safe harbor provision shields third parties from liability if they act in good faith, even if the POA turns out to be invalid. However, for this protection to apply, the POA must appear to be executed correctly, and the recipient must not have actual knowledge of forgery, voidness, or misuse of authority. This provision does not protect parties involved in fraudulent activities. These legal changes in the New York POA make it easier for agents, principals, and estate planning attorneys to work within the system. A well-prepared POA, along with other advanced directives, can provide valuable protection when needed. Don’t wait until a crisis; start planning today for a more secure tomorrow.

Navigating Florida’s Perilous Spousal Estate Inheritance

Navigating Florida’s Perilous Spousal Estate Inheritance By Max Elliott October 25, 2023 Contributing Author: Nicole Page Florida law provides significant protection to surviving spouses who have been disinherited or left a small share by their deceased spouses. In Florida, a spouse cannot be disinherited by a will or a trust, which is different than Illinois, where a spouse can be disinherited by using a trust. Florida law gives spouses the option to choose to inherit what was left to them according to their deceased spouses will or the choice to elect to receive a percentage of the elective estate. A surviving spouse usually elects to take an elective share in situations where the deceased spouse attempts to disinherit them or leaves them less than they would receive if they took an elective share. The amount of the elective share is a case-by-case analysis, depending on the value of the estate. There is no fixed number, but rather a percentage – up to 30% of the deceased spouse’s estate. It’s also important to note that some assets that aren’t typically a part of an estate are considered to determine the surviving spouse’s elective share. This means that an attempt to circumvent the elective estate statute by distributing assets into a trust may still not be sufficient to disinherit a spouse. Florida does not discriminate by codifying what type of character the spouse had or the nature of the relationship between the spouses. This means that even if the spouses have been living separately for years, it does not infringe on the right to the elective share. As long as the spouse is a Florida resident and still married at the time of the death, they can claim the elective share. Barriers to claiming the elective share are: Executing a valid premarital or postmarital agreement. Required procedural protocols: The surviving spouse must file a written notice that they are invoking the elective share statute with the probate court within 6 months after the date of service of the notice of administration or 2 years after the date of the decedent’s death. Still, if you would prefer to provide for your children because you’re in a second marriage, beware of what’s lurking beneath…

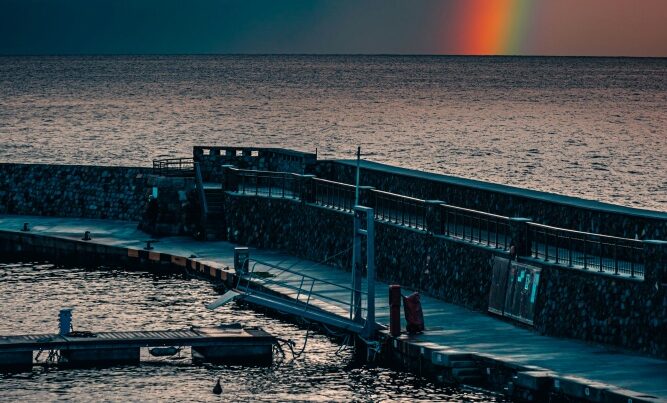

Attention NY Legal Professionals: Smoother Sailing Ahead for Obtaining Sworn Statements

Attention NY Legal Professionals: Smoother Sailing Ahead for Obtaining Sworn Statements By Max Elliott April 3, 2024 By Gabrielle Wasenius In New York, attorneys have traditionally been permitted to submit affirmations to courts instead of affidavits, the law controlling this practice, CPLR 2106, removed the prior mandate for attorneys to acquire a notary public’s oath before presenting their sworn statements. The CPLR drafters believed that attorneys’ professional responsibilities and the potential for prosecution for false statements were adequate safeguards against dishonesty, thus eliminating the necessity for a notary public. Additionally, the law allowed specific medical professionals to affirm the veracity of their own statements. In 2014, CPLR 2106 was amended to permit affirmations instead of affidavits from individuals located outside the United States, Puerto Rico, the United States Virgin Islands, or any territory under U.S. jurisdiction. This change sometimes made obtaining a statement from someone overseas than from a person in a nearby state easier. On October 25, 2023, Governor Kathy Hochul signed two laws amending CPLR Rule 2106. Effective immediately, A06065 / S02997 expanded the scope of who can make affirmations in civil actions to include all licensed healthcare professionals. Effective January 1, 2024, A05772 and S05162 allowed affirmations in lieu of affidavits to be made by any person in a civil action. The new law applies to both new legal actions initiated on or after January 1, 2024, and to actions that are still pending as of the effective dates. Now, a statement made by any individual and affirmed by that individual as true under penalty of perjury can be used in a legal action in New York as a substitute for an affidavit, with the same legal weight. The affirmation should contain this language: I affirm this ___ day of ______, ____, under the penalties of perjury under the laws of New York, which may include a fine or imprisonment, that the foregoing is true, and I understand that this document may be filed in an action or proceeding in a court of law. (Signature) Keep in mind, the new CPLR 2106 does not eliminate the need for notarized affidavits and affirmations entirely. Notarization will still be required in cases where the law mandates the declarant to verify their identity or the document’s authenticity. Nonetheless, this amendment modernizes New York law, aligning it with practices in more than 20 other states. It will reduce the burden on litigants, witnesses, clerks, and courts. Moreover, it helps to overcome logistical and financial barriers, like trying to obtain a notarized document from a non-New York heir who is party to a New York action. Hopefully, this change reflects New York’s dedication to adapting its legal system to meet contemporary needs and challenges.

Our Country…‘Tis of Thee

Our Country… ‘Tis of Thee January 20, 2021 WE ALL KNOW that the American ideal of democracy is just that, an ideal: People are citizens of this country, the United States of America, who the Founders never imagined would be granted citizenship; people in this country, regardless of the color of their skin, are considered equivalent in Black Letter Law, at our very least attempt at justice and in the spirit of the law at our very best, which is something many founding persons never believed should be; and most citizens in this country are endowed with the authority to cast a ballot for whom they believe represents their interests, which is an authority that many of the Founders disagreed with bestowing upon the “common man,” let alone woman. That American democratic ideal, however, did not really begin to take shape as a force to be reckoned with until the Voting Rights Act was passed; until the Honorable Justice Thurgood Marshall took his seat upon United States Supreme Court followed by the Honorable Justice Sandra Day O’Connor; and until Barack Hussein Obama was voted in as the 44th President of the United States. That American democratic ideal was most recently tested to its core by an attempted insurrection of the United States government, and like the administration that lifted the insurrection, the attempted insurrection should not be viewed with dismissive side-eyes. It is telling that a large percentage of this country is sufficiently, miserable, un- or misinformed, and fearful that they would risk decapitation of the only body that ever kept most enemies from their doors and their shores. That American democratic ideal is assuredly injured. And, yes, this isn’t a cumbaya moment. It isn’t a moment to breathe a sigh of relief. It is a moment to inhale, hold it, feel the American heartbeat, hear the American lungs, and exhale, slowly, ever so slowly, and note the American body politic’s response, and get to work, to recover and move forward and strengthen that American ideal. Still, we may not be breathing a sigh of relief, but that does not mean there is no relief being felt and seeking to be shared because… That American ideal… MY country ‘tis of thee…lift EVERY VOICE AND SING…from SEA to SHINING SEA… let FREEDOM and JUSTICE for all…ring.

And We Rise…Together

And We Rise… Together January 9, 2021 https://maxelliottlaw.com/wp-content/uploads/2025/06/2021-Horizons-and-Hopes.mp4

Highlights Return!

Highlights Return! January 25, 2023 https://maxelliottlaw.com/wp-content/uploads/2025/06/2023_Highlights_Horizons_Final.mp4

The Guardianship Abyss

The Guardianship Abyss January 11, 2023 One reason why estate planning is so appealing to me is that it helps to keep family assets in the family. Generally, if you’ve had a Last Will and Testament, Trust, and Powers of Attorney (POAs) for financial matters prepared, your loved ones can enjoy your gifts upon your passing and, equally important and relevant for this discussion, you and the fruits of your labor will be protected during your lifetime. I used the term “generally” because sometimes even when these instruments are in place, caca happens, and I’ll get to those situations in a minute. But let’s just consider the usual and oh so unfortunate situation… Mom is elderly and has all of her marbles. Mom, unfortunately, catches COVID-19 and as a result, even after surviving it has “COVID brain.” Her mind wanders as she mops the kitchen floor and she slips and falls. During the fall, Mom hits her head on the kitchen counter before landing on the floor where she hits her had again. The blows to her head cause Mom to suffer a stroke. Until the fall, Mom not only had all her marbles but was fully functional – paying all her bills and was the only one on her financial accounts and deed. Now, she’s relearning basic care, has no idea how to pay for anything, and depends on you and her healthcare providers. So you need to access her accounts to pay her bills. However, Mom has no estate planning in place – no financial POA and no Trust. You research “the Google” and even check out ChatGpt, which tells you the POA is what you need. So you phone an attorney, who just renewed their license, and when you told them that you needed a Power of Attorney and why, my colleague responded, “Sorry, your Mom lacks the required mental capacity to sign a POA.” Now what? In Illinois and other jurisdictions, what is needed is guardianship. But obtaining and sustaining guardianship can be arduous and costly and, for many seniors, permanent. This means the court-appointed guardian, who could be you or a financial institution or your or their attorney must go to court almost every time you Mom wants something that falls outside the court-approved budget, until she dies. If Mom recovers from the stroke but needs help managing finances and getting around, she will likely be subject to guardianship for the rest of her life, which means her assets (or yours) will be going to pay court and attorneys’ fees for the rest of her life. Once a disabled elderly person becomes subject to guardianship, they are usually in the court system permenantly. However, like I stated earlier, estate planning instruments, like a Trust or a financial POA can prevent this from happening…most of the time. When these instruments don’t work, it is often because relatives of the POA agent or Trustee see Mom’s health fading, whereby her morbidity is in sight along with her estate. And so the battle begins to change the POA or the Trust. And this battle more often than not ends up in guardianship court, costing the family or Mom or both tens of thousands of dollars. Indeed, avoiding guardianship is one reason why having a solid estate plan, where fiduciaries are ot so easily challenged, is critical. And yes, the Q&A I hate most: Q: How long will my parent need to stay in guardianship. A: Until they pass away. Dead silence.

Is Your Small Business Ready for FinCEN?

Is Your Small Business Ready for FinCEN? May 28, 2023 On September 30, 2022, the U.S.’s Financial Crimes Enforcement Network (FinCEN) issued its final rule on Beneficial Ownership Information Reporting Requirements, mandated by the Corporate Transparency Act (CTA). The rule aims to combat money laundering and terrorism by collecting and maintaining Beneficial Ownership Information (BOI) for U.S. businesses. It addresses the use of corporate structures, such as Limited Liability Companies (LLCs) by illicit actors and aligns with international efforts to combat unlawful activities. The rule outlines reporting requirements, including who must report and the violation consequences that are costly (like $500/day!). The current U.S. framework for combating money laundering and terrorism has shortcomings, making it attractive for illicit actors to create hidden shell companies. The final rule requires new covered businesses to submit timely BOI reports to FinCEN within 30 days of establishment. Existing businesses have until January 1, 2025, to submit their initial reports. Accuracy and updated information are emphasized. Reporting companies must include specific information in their initial reports, such as legal name, trade name, address, jurisdiction of formation, and EIN or TIN. They must also provide details of each beneficial owner and company applicant, including full names, dates of birth, addresses, unique identifying numbers, and images of identification documents. Corrected and updated information must be reported later. The final rule defines a “beneficial owner” as an individual who exercises substantial control over the reporting company or who owns at least 25% of the company (ownership interest). Exceptions to the definition include minor children, nominees, intermediaries, custodians, agents, employees, individuals with future inheritance interests, and creditors. If no exceptions apply, beneficial owners can be identified based on substantial control and ownership interests. The rule provides indicators of substantial control and clarifies the definition. Businesses must determine if they are considered reporting companies for purposes of the final FinCEN BOI rule. Domestic reporting companies include corporations, LLCs, or entities created by filing documents with a secretary of state or similar office. Foreign reporting companies are entities formed under foreign law and registered to do business in a state or tribal jurisdiction. The rule does not add exemptions beyond the 23 specified in the CTA. Companies must also determine the extent of their reporting obligations and maintain a record of changes in company applicant information. The definition of a company applicant is limited to one or two persons. Additionally, existing companies are exempt from providing applicant information, but new companies must comply. Complying with the final rule may be challenging, because it involves analyzing multiple individuals with ownership interests and substantial control. FinCEN has not imposed limits on the number of beneficial owners to be reported to create a comprehensive database. Small businesses may benefit from legal counsel to navigate and comply with these measures.

Welcome to Pride 2025…Regardless

Welcome to Pride 2025…Regardless June 2, 2025 I’ve been writing and speaking on LGBTQ+ rights as they intersect with estate planning and otherwise since the inception of my firm. (The advocacy is related to my lawyer origin story.) In fact, serendipity had our firm launch on the day Illinois passed the Civil Union Act – June 1, 2011. Then, in 2015, the U.S. Supreme Court ruled for marriage equality in Obergefell v. Hodges. Still, that ruling was a plurality, which means the ruling could be readily overturned if the Court agrees to hear another marriage equality case, if the case is founded on a different legal argument. Perhaps reading the tea leaves or understanding the direction of the Court, in 2022, former President Biden, signed into law the Respect for Marriage Act. The law undergirded interracial marriage, repealed the infamous DOMA, and required states with mini-DOMAs to respect same-sex marriages if the couple was married in a jurisdiction that provided same-sex marriages. So, same-sex marriage is safe, right? DOMA was signed into law in 1996 by former President Bill Clinton. The law defined marriage as a union between one man and one woman. Technically, same-sex marriage is safe. However, the benefits that accompany marriage are still governed by state and federal law and the doctrines espousing states’ rights are more popular now and the Supreme Court has a different composition than it did in 2015. So, not only are same-sex marital rights in question, but rights that were afforded LGBTQ+ persons are in the line of fire. The results: second-parent adoptions for same-sex couples are being sought more now than ever in addition to amended estate plans that protect LGBTQ+ couples regardless of their domicile; and any other protections that can be provided by law.It is unfathomable the reverse course that LGBTQ+ rights are confronting, but the Stonewall Generation doesn’t forget.