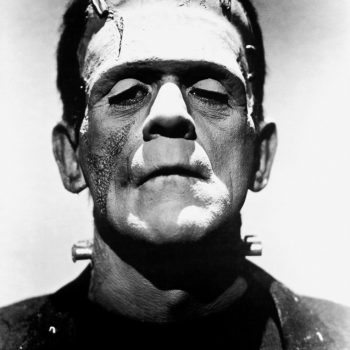

We Were Surfing, Then a Shark Ate Her

What Happens if You Die Without a Will While On Vacation? It was going to be the best honeymoon ever. We met a couple of years post-divorce for both of us, and fell madly in love with each other and each other’s children. We were financially secure and each of us had our own wealth and intended to keep our assets separate. The water was beautiful and blue and the waves were amazing. We went out on our boards and out of nowhere appeared a grey fin, an ugly snout, and then menacing black eyes. She freaked out, fell off, that thing opened its snout, showed teeth, and the center half – 1/3 – of my new wife’s body disappeared. Then all hell broke loose. We had quickly prepared powers of attorney prepared before we left and were planning to have an estate plan prepared by an attorney once we returned. My wife was particular about how she wanted her remains disposed – she wanted to be buried in the most sustainable and economical way. At the hospital, researchers appeared and refused to release her body. Unlike our home state, in this state, doctors were the final decision-makers on dispositions of remains. So I had to leave her remains in a strange place. I’m also going to have to pay thousands of dollars to a healthcare system because we didn’t have traveller’s insurance. When I returned home, I learned that some of her accounts had no designated beneficiaries, so instead of everything going to her children, her children will have to split everything with me. When they found out about that, they began blowing up my cell phone asking me what I intended to do. Of course, I intend to give them the 100% of my share but one of them is a spendthrift – money burns holes through their pockets and my wife was adamant about being careful how much to give to this child on a regular basis. That has caused some friction between all my stepchildren. Also, since my wife had no Will or Trust, her estate must go through probate. In this state, because I’m the surviving spouse, I have preference in acting as an administrator for her estate. This issue also created discord between me and my stepchildren. That frickin’ shark! I think what I’m going to do is use part of my half to create a trust for the spendthrift child to shelter at least part of their share of the estate, and they are not going to like that, but I know it’s what my wife would have wanted. She would have been very upset with the fact that this kid, who she actually suspected as being a functional addict, is going to obtain 1/6 of their share completely outright. I really hope the kids don’t blow through their inheritance; they are still young adults, just a few years out of college. Her estate was rather large, so I also must obtain insurance to cover the value of her estate, which cost the kids thousands of dollars. My wife was also working with a tax professional because she also had a significant tax liability that they were disputing with the IRS. That means I can’t distribute her estate to the kids (or anyone else) until that issue is resolved. How am I going to explain that to the kids? Maybe I can provide a partial distribution, but I still need to have some appraisals done – she owned a couple of rental properties and a small online business. I really miss her – she was fun but brilliant. This is a mess… And a fictional story…kinda

Probate Horrors: Not All Fiction, Unfortunately

Probate is the court process generally required when a person with assets dies without a Last Will and Testament or some other testamentary mechanism in place that designates who should receive those assets. In Illinois, probate is lengthy – at least 14 months; costly – initial processing fees start at $850 and the average retainer is $2500; and assets are frozen for at least 6 months – so heirs cannot obtain their inheritance. So, in Illinois, unless there’s a possibility that an estate will face a protracted and costlier lawsuit, probate should be avoided. But sometimes, as much as we try, folks just don’t listen: The Other Heir Abe died without a Will, leaving his surviving spouse, Christine, and Brandy, the 3 year-old child borne of their marriage, as heirs. At the time of his death, Abe owned a small business, a home, and about $300,000 in a bank account. Christine was informed that because the bank account was the only asset with a designated beneficiary, the estate would require probate. Unbeknownst to Christine, Abe had another child, Donald, who he’d been supporting even before his marriage to Christine. Donald’s mother promised Abe that she would not confront Christine because the payments she received from Abe were 4 times as much as what she’d receive in child support. At the time of Abe’s death, Donald was 6 years of age. But then Abe died and so did all payments to Donald’s. At Abe’s death, his estate balance sheet and the probate distribution would resemble this: Estate AssetsHome, $250,000Business, $500,000Bank account, $300,000 (but this belonged to Christine)Total non-designated assets: $750,000 LiabilitiesBusiness creditors $250,000Tax Liabilities, $50,000Estate administration fees, $10,000Total Liabilities: $310,000 Distributions to HeirsChristine, 50%, $205,000Brandy, 25%, 102,500Donald, 25%, $102,500 Abe had always been concerned about Donald’s mother’s spending habits; so Abe paid many items, medical bills, clothing, and daycare directly on behalf of Donald. Now, because Donald was a minor and Abe did not plan for him in a Trust, Donald’s mother, the spendthrift, would likely be appointed Guardian of Donald’s estate with direct access to $102,500. Estate planning could have provided benefit for Donald, even without Christine and Brandy ever knowing. But… Abe didn’t plan. That DNA kit/Ancestry App Suppose that Donald was an adult and had just received results from a genealogical investigation, which illustrated that he and Abe were 99.9% son and father. He decides to search for Abe and learns that Abe just died. Christine refuses to meet with him; so Donald shows up in court… Hence, the reason why probate courts also have bailiffs. What if Donald was also a spendthrift or worse? Could he inherit?

A Mother\’s Love Doesn\’t Include Dad\’s New Wife

When a spouse dies, leaving behind a surviving spouse, children, and considerable assets, the surviving spouse should tread carefully with respect to estate planning instruments governing those assets. The 2016 Illinois Appellate case, Gwinn v. Gwinn, is a good example of this premise. Background Facts Ken Gwinn, Sr. and Betty were married with 4 children. In 2002, Betty established a trust, providing for Ken and their children. If Betty predeceased Ken, he was the designated Trustee, which meant that he had a fiduciary duty to abide by the terms of the trust. In 2009, Betty died. Her estate consisted of approximately $600,000 in liquid assets, a mortgage-free home in Illinois valued at approximately $750,000, and farm property. The terms of the trust gave Ken as much of the trust income as he wanted and a discretionary, albeit limited, amount of the trust principal. Upon Ken\’s death, the remaining trust assets were to be divided equally among the children. Two years after Betty’s death, Ken married Maria. After marrying Maria, Ken withdrew $475,000 from the trust to buy a home in Colorado for him and Maria. The Colorado home was titled solely in Maria\’s name and, thus, represented a gift from Ken Sr.’s late wife’s trust to his new wife. Needless to say, the kids were not pleased. So 3 of the 4 children filed a lawsuit against their father claiming breach of trust and breach of fiduciary duty because this gift was “extraordinary” (a legal term of art for gifts that are beyond the scope of intent) and went beyond trust terms. The lower court ruled in favor of the father and the children appealed. Appellate Court Analysis and Findings The Appellate Court agreed with the children, in finding that the trust was established for their benefit in addition to their father’s benefit. However, the Court also asserted that their father was the intended primary beneficiary during his lifetime and, as trustee, had broad discretion over distributing gifts from the trust to himself as beneficiary. Nevertheless, that discretion was not absolute. After considering the cardinal rule of the “intent of the testator or settlor,” specific limiting language in the trust, relevant case law, and persuasive legal treatises, the Court ruled that the discretion of gifting from the trust was limited to Betty’s descendants. Clearly, Maria was not Betty’s descendant. Additionally, even if Ken tried to cloak the gift to Maria in his own beneficiary status, the law precluded him, in his capacity as trustee, from increasing any beneficiary’s gift, including his own. The Illinois home was sufficient; taking $475,000 from the $600,000 corpus was deemed an “extraordinary gift.” The Court, therefore, found that the nearly half-million-dollar gift from Betty’s trust to Maria was not Betty’s intent (ya think?!) and, thus, Ken breached the trust terms. In breaching Betty’s trust terms, he also breached his fiduciary duty to all of the beneficiaries. This year, if your Valentine’s Day gift requires retitling, think twice, just in case.

Dead Clients Do Talk

The legal doctrine of “attorney-client privilege” has become a well-known phrase in the general public\’s lexicon. What the general public does not know is that the “privilege” generally lasts past death. Additionally, what is not understood, even by some attorneys is that the attorney-client privilege is called a “privilege” because the rule is actually an exception to our overarching duty to disclose facts to opposing counsel during disputes. Further unknown to the general public and most attorneys who do not practice in probate or estate administration is the exception to this exception: the “testamentary exception.” A case decided earlier this year, Eizenga v. Unity Christian School of Fulton, Illinois, involved a trust dispute and clarifies this rule and its exceptions for Illinois courts and attorneys. FACTS Walter Westendorf (Westendorf) established trust in 1997, which he amended 7 times before dying in 2013. Dale A. Eizenga (Eizenga) was designated as successor trustee when the trust was initially prepared and executed. In fact, Eizenga, in their capacity as successor trustee, was nearly the only relevant constant during the 16 years after the initial trust was prepared. In 2006, with the trust’s 3d amendment, Attorney Russell Holesinger (Holesinger) became a trustee and Unity Christian School of Fulton, Illinois (School), of which Holesinger also allegedly represented (read potential conflict of Interest), became 1 of 3 charitable remainder beneficiaries. Four amendments later, in 2012, Holesigner became the single second successor trustee and the School became the primary trust beneficiary. Eizenga filed a complaint against Holesinger, alleging “undue influence,\” and eventually sought Holesinger’s client documents. Holesinger refused and a lower court held Holesinger in contempt, and Holesinger appealed on the grounds of attorney-client privilege and the attorney work-product doctrine. As mentioned above, the attorney-client privilege generally lasts past death but for the testamentary exception that provides that in will contests, the attorney-client privilege cannot be invoked. Ironically, in the year of Westendorf’s death, another Illinois case, DeHart v. Dehart, reiterated the testamentary exception. Holesinger argued that this case, however, didn’t involve a will but instead involved a trust. ANALYSIS The Third District Appellate Court then examined the 2010 Graham Handbook of Illinois Evidence, other case law, and treatises addressing this issue and ruled that a will contest is not the only situation where the testamentary exception can be used. Next the court considered Holesinger’s attorney work-product argument. The attorney work-product doctrine is another exception to our disclosure duties, allowing attorneys to protect trial strategies and the mental impressions and opinions used to prepare for trial and establish said strategies. Because the documents in Holesinger’s files were not “created in preparation for any impending or pending litigation,” the Court held that Holesingers documents were not protected by the attorney work-product doctrine and, thus, affirmed the contempt finding by the lower court. The rationale is that a testator or trustmaker (settlor) would want their intent followed; so, if the attorney’s work-product was the only way to settle the dispute, then that information must be made available.

The Slayer Statute in the News Again

Teen allegedly murders mom; mom was affluent; teen charged with murder; teen is poor but retains defense team; asks trustee, who is teen\’s brother for legal expense funds; brother says no; through lawyers teen sues estate to pay legal defense fees. Question: Will teen prevail in lawsuit? According to Illinois\’s slayer statute, it depends. The plain language of the statute provides that one cannot profit from causing another person\’s death: A person who intentionally and unjustifiably causes the death of another shall not receive any property, benefit, or other interest by reason of the death, whether as heir, legatee, beneficiary, joint tenant, survivor, appointee or in any other capacity and whether the property, benefit, or other interest passes pursuant to any form of title registration, testamentary or nontestamentary instrument, intestacy, renunciation, or any other circumstance. The property, benefit, or other interest shall pass as if the person causing the death died before the decedent, provided that with respect to joint tenancy property the interest possessed prior to the death by the person causing the death shall not be However, the operative word in the statute is \”causes.\” This means that the person must be first convicted of knowingly, without legal justification, killing another human being. Ms. Mack hasn\’t been convicted yet. So what may happen? The court may tell defense to bill but don\’t even think about collecting until the jury is in. The next issue is then whether Ms. Mack be able to keep this same defense team.

The Unintended Beneficiary You Should Guard Against

Because approximately 70% of Americans die intestate, that is without a will or some form of legal instrument transferring their estate assets, the probate courts are busy, at least in Illinois. Also busy are folks who want a piece of the pie but are not legally entitled to the smallest crumb of crust. Yet, courts are busy because these folks have misrepresented themselves and rightful heirs must prove their relationships. Worse are situations where heirs don’t have the means to claim their inheritances through the court system and, thus, must relinquish assets that might have been helpful to them or their families. This is the thorny bush that members of blended families and other non-traditional families often experience. So, below are a few primary estate planning documents and ways to prevent assets from falling into the no-good-son-in-law’s or dastardly step-daughter\’s hands. Power of attorney for property Problem: The designated agent can empty your bank accounts before you die. Answer: Name an intended beneficiary under your will as agent and provide explicit instructions in the power of attorney narrowing the agent\’s authority to access the accounts strictly for your benefit, e.g., pay your bills and daily living expenses. Furthermore, provide that the agent can only deplete all resources if it is absolutely necessary for your health or well-being. Use clear, explicit, unambiguous, plain language. If you must name someone who is not an intended beneficiary under your will or trust, make sure that an intended beneficiary has a copy of the power of attorney and narrow the authority more, providing that the agent cannot withdraw more than a particular percentage unless your health and well-being will be jeopardized and that the withdrawal information is shared with intended beneficiaries of your will. Will this stop someone from taking your account to zero if he or she really wants to? No, but it will give intended beneficiaries evidence for court. Power of attorney for healthcare Problem: With the right amount of authority, the designated agent can kill you. Answer: Enough said. Will Problem: The wrong person might inherit your estate. Answer: Explicitly state who will inherit what. Having a trust prepared is even better because then you don’t have to state your intentions explicitly in your will. However, make sure that powers of appointment, i.e., the authority to bequest your gifts to others, are limited in the manner you intend your gifts to be distributed. For example, if you die, leaving a great deal of wealth to your loving step-daughter whose husband is a sloth unworthy of an earwig’s toenail, you probably want language in your will or trust to prevent the sloth from inheriting your assets through your step-daughter in case she dies before they divorce. Revocable Living Trust Problem: The wrong person might inherit your estate and cause probate anyway. Answer: The primary reason for preparing a trust is to prevent your heirs from having to probate your estate. However, if you don’t want to cause your intended beneficiaries to lose some or all of their inheritance in litigation proving their relationship and proving the disinherited was, in fact, soundly and legally disinherited, see the above, \”Will,\” have an in terrorem provision, and, while you\’re lucid, write a letter to the disinherited spendthrift stating your reasons for disinheriting him or her. Upon your death, leave instructions for the trustee to deliver the letter with a copy of the in terrorem provision. You might want to have co-trustees in this case: one who’s a family member and one who is a disinterested party. Probate courts and lawyers are often unintended third party beneficiaries to wills or trusts, but they don’t have to be if estate planning documents are prepared with cautious forethought and care.

7 Deadly Estate Planning Don\’ts

Experience and observation often has me shaking my head as I assist families in correcting mishaps by well-intended loved ones. This article is about some of what those families have learned. Don’t designate minors as primary beneficiaries on anything. Imagine being a divorcee with Peter Pan as an ex-spouse and play-date dad. The unthinkable happens but you’ve left a life insurance policy naming your 12 year-old son as primary beneficiary. Guess who may control the proceeds of that policy? Don’t designate adult children who cannot manage personal finances well (aka “spendthrifts”) as primary beneficiaries on anything either. Imagine leaving $250,000.00 to your daughter who blows it in one year on my favorites – Ralph Lauren, Rancho Mirage, Peach Champagne, Anne Fontaine, Jimmy Choo, and Paris. Note: I’m working my way up to Anne Fontaine. Don’t assume a will does the trick if you’re cohabiting. The potential of inheriting even modest sums of money does strange things to the affinity family members have for each other, let alone what family members may have felt for non-blood-related members. Family members will try to kick a cohabiting partner to the curb so fast, the engraving on the headstone won’t be finished yet. Don’t depend on a will if you and your spouse or partner have children from previous relationships. What do you think will happen if the step-children who you adored and treated so generously during the 15 years of your marriage to their father realize that you’re leaving everything to your children? More importantly, what do you think your kids will do if they realize that you’ve left a substantial portion to the step-kids? Ahhh…the privacy of trusts. Don’t ignore documents with beneficiary designations if you’re recently divorced. Imagine winning a handsome settlement because Peter Pan was also Mr. Gigolo and then, the unthinkable happens, and you didn’t change the designations on your will and life insurance? Antacids don’t work for the dearly departed. Don’t ignore planning if you’re recently married, especially if a prenuptial agreement is involved. And for goodness sake, ensure that your attorney takes care to explicitly define certain items, such as the marital residence, but is not so explicit as in providing the exact address. What if years later, you divorce and the prenupt states you get the house on Rosemary Lane no matter what but your spouse convinced you to sell the house on Rosemary Lane but your will states that in the event of a divorce, the terms of the prenupt govern the property that shall be considered your estate? Don’t ignore planning if you’ve more than one intended beneficiary. Beneficiaries will fight over pennies, over tattered recliners, over cats, over who gets to be administrator. Maybe you’ll enjoy the bickering in the karmic impish sense, but do you really want your estate to pay lawyers’ fees to straighten this out because that’s who will pay, if at all possible, not the beneficiaries, but you and you’ll be dead!

4 Key Concerns on Estate Planning for Disabled Children

A number of articles in The Shark Free Zone address the bad idea of designating a minor as a primary beneficiary. Single parents especially struggle with this issue, which is why “it takes a village,” is more than political rhetoric. Another issue parents and family members struggle with is the unfortunate circumstance of managing the car of a disabled child or loved one. Yet, it is even more critical to plan for unfortunate events when you are the caregiver of a disabled person. As usual, examples often help distinguish bad planning from poor planning but this time we’ll just look at a scenario and the resulting considerations. Twenty years ago, Kelly and Sean’s daughter, Carrie was born mentally and physically disabled. As a result, Kelly and Sean decided that Kelly would remain at home to care for Carrie and the family would depend on Sean’s paycheck and Carrie’s Social Security Disability Income (“SSDI”). About a month ago, Kelly and Carrie were involved in a car accident and ended up with a settlement award of $50,000 after medical expenses were paid. Fortunately, neither Kelly nor Carrie was severely injured but the incident shook Kelly considerably. So she and Sean finally had the “what if” discussion about the possibility of something tragic happening to one or both of them. If one or both of them died, who would care for Carrie and what would that look like? Well, Kelly and Sean have several issues to consider, including: Guardianship v. Powers of Attorney. Carrie is an adult and, in Illinois, obtaining guardianship for a disabled adult is a lengthy and costly process. To avoid that process, powers of attorney for Carrie might be useful. The question of usefulness hinges on the severity of Carrie’s mental disability with respect to legal capacity needed to grant authority provided in powers of attorney. Adverse Implications of Government Assistance. Irrespective of who dies, if sufficient means are not available to ensure Carrie’s basic needs – food, shelter, clothing, and medical care – are met during the remainder of her life, she may need additional government assistance, such as Medicaid. However, when someone on Medicaid receives an inheritance, they may become temporarily ineligible for Medicaid. So particular testamentary planning, such as “special needs trusts,” may be needed. Sufficient Life Insurance. If Sean passes away, the question is then, how much of a death benefit is needed. Also, if Kelly predeceased Sean, who would be the contingent beneficiary able to act on Carrie’s behalf. Appropriate Fiduciaries. If both Kelly and Sean die, the question again is who will be able to financially and compassionately manage Carrie’s estate and how would that estate be structured? Caring for a child with mental or physical challenges has at least one commonality with caring for a child with no challenges: the need for a careful, caring, and protective plan in the event the parent is no longer able to provide needed care because the ability or inability of our loved ones doesn\’t change the fact that they are our loved ones.

Infants, Stairwells & Burning a Million Dollars

Wealth preservation aka “asset protection” is slowly rising to the top of the mainstream American lexicon, much like estate planning did a couple of decades ago. However, though related, the 2 activities are quite different. A solid estate plan’s end goal is to ensure that your intended beneficiaries obtain what you intend for them in the most efficient and least adverse manner possible. Retirement and tax planning are a substantial part of the estate planning process but the primary beneficiary at the end of the game is someone else, not you. Conversely, a solid wealth preservation plan will ensure that you don’t go broke before, during, or after retirement and fulfill your intentions toward your beneficiaries, tying it into estate planning. But the primary beneficiary of wealth preservation is not someone else; the primary beneficiary is you. Estate planning and wealth preservation are technically linked because the core documents and the fiduciary roles are primarily the same. Both include trusts and, consequently, trustees. Both might even include a LLC. The fundamental distinction is jurisdictional, i.e., what law governs the trust. Typically the laws in states that have asset protection statutes and are referred to as Domestic Asset Protection Trusts (DAPTs) govern wealth preservation instruments whose jurisdiction is in the U.S. Instruments whose jurisdiction is outside the U.S. are governed by the laws, or lack thereof, in those particular countries and are known as “offshore” trusts. Now before you start getting all antsy with thoughts of tax evasion, let me squash that thought like a bug. The only way to ensure that one doesn’t incur Uncle Sam’s penalties is by being completely compliant with the U.S. tax code. Now before going too far into the different schools of thought surrounding DAPTs and offshore trusts, you may be thinking, “I don’t have a gazillion dollars, so this doesn’t apply to me.” But before I lose you to Facebook or an incoming text message – wait. If you live in America, you live in one of the most lawsuit crazed countries in the world. So while you may not have a gazillion dollars, consider the following stats: 99% of doctors in high risk specialties will be sued; 75% of doctors in low-risk practice areas will be sued; Every 6 minutes a child under the age of 5 is treated for an injury sustained on a residential stairwell; In 2012, a woman was awarded about $833,000 for an injury sustained on her landlord\’s property ; Over a 10-year period, 15-21 lawsuits were filed per 100 architect firms; I won’t mention lawyers, it’s a given, people hate us, think we have deep pockets, so they sue us. So if you know your liability insurance won’t cover a potential lawsuit or the cost of litigation in successfully defending an unscrupulous claimant, how comfortable are you holding a “fire sale”? If you’re not thrilled about selling your home and liquidating all of your assets, including your retirement portfolio, to settle a claim, then wealth preservation may be needed sooner rather than later. Then again, maybe you have a million dollars to burn…

3 Lessons about Grapes and Taxes

As Baby Boomers start retiring, thoughts of mortality and legacy planning begin to dance in their heads. While most boomers don’t have taxable estates…for now…the future is still a question mark for many. While enjoying retirement – golf course, cruises, mountain climbing, museum walks, wine tasting, and theatre galas – plans should be made for a time when the retirement funds must be transferred to someone else. It is critical to know how to transfer retirement proceeds properly so the distributions won\’t be literally and figuratively taxing: Claire and Cliff are in their mid 60’s. They’ve a modest estate – home valued at about $250K with most of its equity remaining, life insurance, and retirement benefits at about $2 million. Half of the retirement proceeds is in a 401(k), 25% is in an IRA, and 25% is in an annuity. They also have 2 kids: Lenny and Lisa. Lisa’s a starving artist, who is barely in the 15% tax bracket but who also has a vivacious and smart teenager. Lenny is 10 years older than Lisa and a savvy professional about to move into the highest tax bracket and has no intention of marrying or ever having children. Claire and Cliff want to distribute their estate to Lisa and Lenny equally and have been told to give the retirement proceeds to Lenny and Lisa outright. Before doing that, however, I would ask them to consider the following in a simultaneous death situation, where Claire and Cliff went down with the Titanic III: An outright gift from a 401(k) or a traditional IRA will be taxed and if the beneficiary is over 59 ½, the 10% penalty may also apply. For Lenny, who’s Mr. Money Bags, that doesn’t present too much of a problem, though no one wants to pay taxes. For Lisa, that would be a boon indeed. But an outright distribution to Lisa would yield less than what she would receive were the proceeds titled to a trust because of income tax consequences. Pick the fruit too young and the wine will be bitter; too old and you may taste too much oak. Claire and Cliff could have the proceeds placed in a trust for Lenny and Lisa. Here, part of Lisa’s benefit would be driven by Lenny’s life expectancy because he is the oldest, which would provide her with fewer years of income. Additionally, Lenny and Lisa must be sure to withdraw at least as much as the minimum required distribution annually or face a hefty penalty. Different varietals require different soils. In a qualified (retirement) annuity, the entire amount of the contract must be withdrawn over the 5-year period following Claire and Cliff’s death. Again, okay for Lenny, but not so okay for Lisa. Tax consequences also apply to this issue. Cabernets are as good as zinfandels; it\’s the consumer\’s tolerance that is key. Just like no 2 families are alike, no 2 children are alike. So make sure that your children know how to make decisions about the different types of distributions they can choose, after you enjoy your fruits. That way, the remaining fruit will, in fact, go to your children and not the community jelly jar.