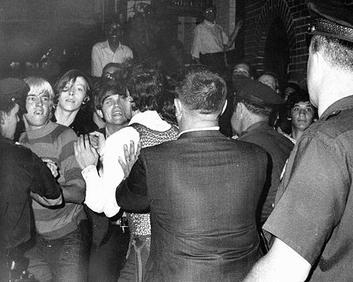

Welcome to Pride 2025…Or Stonewall Pt 2

I’ve been writing and speaking on LGBTQ+ rights as they intersect with estate planning and otherwise since the inception of my firm. (It’s related to my lawyer origin story.) In fact, serendipity had our firm launch on the day Illinois passed the Civil Union Act, on June 1, 2011. Then, in 2015, the U.S. Supreme Court ruled for marriage equality in Obergefell v. Hodges. Still, that ruling was a plurality, which means it could be readily overturned if the Court agrees to hear another marriage equality case, that is founded on a different and novel legal argument. Perhaps reading the tea leaves or understanding the direction of the Court, in 2022, former President Biden, signed into law the Respect for Marriage Act. The law undergirded interracial marriage, repealed the infamous DOMA, and required states with mini-DOMAs to respect same-sex marriages if the couple was married in a jurisdiction that provided same-sex marriages. So, same-sex marriage is safe, right? DOMA was signed into law in 1996 by former President Bill Clinton. The law defines marriage as a union between one man and one woman. Technically, same-sex marriage is safe, but the benefits that accompany marriage are still governed by state and federal law and the doctrines supporting states’ rights are more popular now and the Supreme Court has a different composition than it did in 2015. The results: second-parent adoptions for same-sex couples are being sought more now than ever in addition to amended estate plans that protect LGBTQ+ couples regardless of their domicile; and any other protections that can be provided by law. It is unfathomable the reverse course that LGBTQ+ rights are confronting, but the Stonewall Generation doesn’t forget. So, Welcome to Pride 2025. On September 30, 2022, the U.S.’s Financial Crimes Enforcement Network (FinCEN) issued its final rule on Beneficial Ownership Information Reporting Requirements, mandated by the Corporate Transparency Act (CTA). The rule aims to combat money laundering and terrorism by collecting and maintaining Beneficial Ownership Information (BOI) for U.S. businesses. It addresses the use of corporate structures, such as Limited Liability Companies (LLCs) by illicit actors and aligns with international efforts to combat unlawful activities. The rule outlines reporting requirements, including who must report and the violation consequences that are costly (like $500/day!). The current U.S. framework for combating money laundering and terrorism has shortcomings, making it attractive for illicit actors to create hidden shell companies. The final rule requires new covered businesses to submit timely BOI reports to FinCEN within 30 days of establishment. Existing businesses have until January 1, 2025, to submit their initial reports. Accuracy and updated information are emphasized. Reporting companies must include specific information in their initial reports, such as legal name, trade name, address, jurisdiction of formation, and EIN or TIN. They must also provide details of each beneficial owner and company applicant, including full names, dates of birth, addresses, unique identifying numbers, and images of identification documents. Corrected and updated information must be reported later. The final rule defines a “beneficial owner” as an individual who exercises substantial control over the reporting company or who owns at least 25% of the company (ownership interest). Exceptions to the definition include minor children, nominees, intermediaries, custodians, agents, employees, individuals with future inheritance interests, and creditors. If no exceptions apply, beneficial owners can be identified based on substantial control and ownership interests. The rule provides indicators of substantial control and clarifies the definition. Businesses must determine if they are considered reporting companies for purposes of the final FinCEN BOI rule. Domestic reporting companies include corporations, LLCs, or entities created by filing documents with a secretary of state or similar office. Foreign reporting companies are entities formed under foreign law and registered to do business in a state or tribal jurisdiction. The rule does not add exemptions beyond the 23 specified in the CTA. Companies must also determine the extent of their reporting obligations and maintain a record of changes in company applicant information. The definition of a company applicant is limited to one or two persons. Additionally, existing companies are exempt from providing applicant information, but new companies must comply. Complying with the final rule may be challenging, because it involves analyzing multiple individuals with ownership interests and substantial control. FinCEN has not imposed limits on the number of beneficial owners to be reported to create a comprehensive database. Small businesses may benefit from legal counsel to navigate and comply with these measures.

Diverse Family Legacies

Not only is it PRIDE month, but it\’s also our anniversary! As we reflect on our 12 years of service, we look fondly on plans we\’ve created for families who the law once ignored and persons who are currently under attack by laws in certain states. Yes, marriage equality is the law of the land, but if you\’re a transgender person, you and your marriage has a target on its back. Additionally, diverse families are also under attack. The Law Offices of Max Elliott wholeheartedly agrees with the travel advisory… Diverse families include LGBTQ+ families; blended families with step-children, adopted children, or godchildren treated like children; non-married couples with adult children; and more. Your families (like ours) require carefully crafted solutions to ensure that your legacy is fulfilled, and this planning for beautifully diverse families and persons is what we\’ve been doing ever since our doors opened on the day that Illinois passed the Civil Union Act. #LGBTQ+rights #estateplanning #protectingtodaysfamilies

DEI and Estate Planning: The Economic, Non-Business Case, Imperative

National Estate Planning Awareness Week has come and gone. But it was busy! I presented LGBTQ+ estate planning tips and a helpful loophole to members of the Dramatists Guild. Next, esteemed panelists and I shared thoughts about diversity and inclusion and the wealth gap in the context of the estate planning profession. Then, there was the usual stuff, non-stop. Estate planning loophole, you ask? Yes, there is for unmarried couples of certain ages with retirement assets. Contact us to learn more. Diversity & Inclusion and the wealth gap in estate planning, you ask? Yes, for me and our firm, diversity’s moral imperative is a given. Yet, there’s an economic imperative beyond the business case: To be successful in the U.S., one must be financially successful, which means be gainfully employed so that you can enjoy a comfortable living. Appropriate DEI initiatives in the estate planning profession, a profession traditionally dominated by old, white guys, address not just the mythical pipeline issue but compensation and retention issues, which ultimately address the wealth gap. Thus, it’s an economic imperative for estate planning firms to be authentically diverse and equitable and inclusive. (Read: Diversity is not just on our website or in support but front and center in our firm\’s planning professionals and we\’ve been this way since day one.) Mythical pipeline issue, you ask? Yes, but we’ll save that discussion for another day.

Revisiting We ALL Do…

June is PRIDE month and to celebrate…all month long, we\’re revisiting the one of the most important decisions for our friends, family, and clients in the LGBTQ community: Obergefell v. Hodges, which gave the community marriage equality. To start things off, let\’s consider the 4 \”principles and traditions\” the Supreme Court of the United States used to justify its Opinion and, thus, marriage equality: \”Individual autonomy\” encompasses the right to decide who one will marry. See Loving v. Virginia. And in case you\’re wondering, \”individual autonomy\” is legalese that underpins the Declaration of Independence, the instrument that declares individuals free to pursue happiness. The union of marriage is a fundamental right because the intimacy of the marital union is unique and depriving same-sex couples from the recognition and protection of that intimacy is wrong. Marriage equality helps protect the emotional stability of children borne or adopted into same-sex marriages, by equalizing their families with heteronormative families. Marriage is one of the bases of America\’s social and legal order. Depriving same-sex couples from enjoying the benefits of marriage, which includes social stability, would be \”demeaning. Individuals must be free to pursue happiness. That happiness can be found in the remarkable closeness of the marital union. Generally, children are the fruit of marriages and children must be protected because they represent the future. Thus, marriage is a societal bedrock in which most adult individuals must be able to participate. Sounds simple, but it took us almost 50 years to get here.

What if I\’m Neither: Practical Planning Tips for Transgender and Queer Persons

Welcome to our 4th segment in our series on estate planning for transgender and queer persons. When planning for the \”T\” & \”Q\” of the LGBTQ community, attorneys must understand the overlapping factors and relationships between retirement planning, estate planning, gender definitions, and legal interpretation. While we can control some factors, such as estate planning and applicable definitions, other factors, such as the laws governing retirement plans and statutory definitions of gender, are typically out of our control. Additionally, estate-planning attorneys should consider planning in the context of Windsor for transgender and queer persons as we do for all clients: examining financial and non-financial issues. Yet, most attorneys also agree that non-financial issues are usually the more challenging part of planning. The 3 categories generally considered in non-financial estate planning conversations are: (1) the client’s health and the health of close family members and loved ones; (2) family dynamics; and (3) lifestyle and retirement goals. This article focuses on health and issues attorneys face with healthcare Advanced Directives. Good health and healthcare is important to everyone; transgender and queer persons may have more or less issues and some of their issues are different. So, this issue may or may not be important, and is only one of many for transgender and queer persons. Assessing a client’s health for purposes of estate planning includes, but is not limited to, issues surrounding chronic or terminal illness. For transgender and queer persons, we should consider the implications of sexual reconstruction and potential related matters, e.g., whether our client has or had a therapist. All of these issues should be addressed in our clients’ Advanced Directives. Other than certified copies of vital records, Advanced Directives are probably the most important documents a person can have during their lifetime. Additionally, like lesbian, gay, or bigender persons who are unmarried, transgender and queer persons generally need more than a basic power of attorney for healthcare and a living will and even if married. Advanced Directives should include: 1. Illinois Statutory Power of Attorney for Health Care; 2. Illinois Statutory Power of Attorney for Property 3. HIPAA forms 1 and 2 4. Illinois Mental Health Treatment Declaration 5. Hospital Visitation Authorization form 6. Illinois Living Will 7. Illinois Department of Health DNR-POLST To be clear, a person’s sexual physiology is generally irrelevant for purposes of protecting a transgender or queer person’s interests. What is relevant and most important is how that person identifies on the societal gender scale. What is also relevant are the facts as that person wants them communicated, how and when the facts should be communicated, to whom those facts must be communicated, and that those facts are accurately and legally. The Illinois Power of Attorney Act changed substantially last year, and the changes went into effect January 1, 2015. The changes provide individuals with more options regarding the authority they grant to their agents. Yet, more options also requires the need for more information on the part of the principal, which is why we do not recommend individuals completing this form without the assistance of an attorney. The issues to consider in the new Illinois Power of Attorney for Healthcare form cover 5 pages of questions whose considerations could result in a disastrous miscommunication of facts if not done in precise legal context. Again, before addressing financial matters, especially for transgender and queer persons, estate-planning attorneys must ensure that carefully prepared Advanced Directives are in place. Otherwise, the wills and trusts could easily be contested and nullified. Estate Planning for the T&Q of the LGBTQ Community: Part 1 | Part 2 | Part 3 | Part 4 | Part 5

Will Marriage Equality Be Recognized Nationally?

The marriage equality march is returning the U.S. Supreme Court again this April and this time, the Court may just determine to end the continued discrimination against same-gender couples in the 14 states that refuse to allow loving, committed couples of the same gender to marry. The plaintiffs who caused the straw on the camel\’s back to break are a lesbian couple from Michigan whose case created yet another division between the 36 who get it and the 14 who don\’t. If you\’re familiar with our marriage equality work, you know we\’ve been watching and participating in the marriage equality march from our firm\’s inception. So, we are pleased that some sources report that Chief Justice Roberts may side with the plaintiffs in this case. Note, C. J. Roberts did not decide on the constitutionality of state bans in Windsor, and left himself room to join or, even pen, the appropriate decision in this case. Why? Because of Loving v. Virginia, which we and other colleagues have long argued is the fundamental legal basis for providing national marriage equality. Other legal analysts also wonder if the Court will revisit the term \”animus\” because the seminal cases involving recognizing individual rights for the LGBTQ community involve a determination of animus on the part of opponents to LGBTQ rights. The Court has allowed extra time for arguments. The decision is likely to be reached at the end of June. We are confident where the socially conservative 3 justices – Thomas, Scalia, and Alito – will stand. We are also confident where the socially liberal justices – Ginsberg, Breyer, and Kagan – will stand. Many also think that Kennedy will side with the liberal 3 but we\’re not so sure given his recent decisions on individual rights involving minorities. Additionally, Sotomayor was the intervenor for Kansas, providing opponents of marriage equality to at least temporarily prevail in upholding Kansas\’s marriage equality ban. Thus, we\’ve got a number of interesting scenarios confronting the question: Roberts votes with Ginsberg, Breyer, and Kagan and Kennedy, who sided with them in Windsor, will create a plurality allowing for marriage equality in America and thus, creating the United States of America once again, at least with this issue; Roberts votes with the liberal 3 but Kennedy and Sotomayor do not, leaving the patchwork and discrimination in place; Roberts votes with the conservative 3 but Kennedy and Sotomayor side with the liberal 3 (see plurality cited in #1); Roberts sides with the conservatives and Kennedy or Sotomayor also side with the conservatives (see patchwork and discrimination in #2). June will be a very interesting month indeed – for the LGBTQ community, for America, and for the Roberts Court legacy.

Love & the Law: A Polar Vortex Campfire Tale

Updated May 27, 2023 Amidst Polar Vortex 1 of January 2014, a group of wonderful folks and yours truly sat around a warm office, invited by IntraSpectrum , discussing LGBTQ relationship rights. I introduced them to my series Love & the Law, here, as briefly as I could and we had a great time. So, really, what does all of this mean? Well, my (former) rockstar intern, Emily Welter, boiled down my hefty remarks into a few poignant and fabulous images and take-aways: The equality fight then The equality fight later… and… DOMA … and … WINDSOR and … SCOTUS… and POTUS… OH MY! Much like Dorothy and her gang, our Nation’s lawmakers followed a harrowing yellow brick road to marriage equality for over 50 years. We have come a long way from the 1966 case of Loving v. Virginia and we made positive strides towards that “Emerald City” of equal love. Below are 8 key points to know about the legal changes that took place in 2013 – aka the “Watershed Year” – which have affected Estate Planning for today’s LGBT couples: Several States passed marriage equality laws; SCOTUS (\”Supreme Court of the United States\”) ruled in favor of lesbian surviving spouse, Edith Windsor; SCOTUS ordered the IRS to treat legally married same-sex couples the same as straight married couples; The IRS mandated equal treatment of legally married LGBTQ couples for all tax treatment; The IRS called employers to issue FICA refunds to legally married LGBTQ couples; The IRS called on other agencies to comply with the new IRS rules; USCIS removed its barrier to legally married LGBTQ immigrant spouses; AND, finally Illinois passed same sex marriage(!); SCOTUS ruled in favor of marriage equality in Obergefell v. Hodges; and President Joe Biden signed the Respect for Marriage Act, repealing DOMA and helping ensure marriage equality for all U.S. persons.

The IRS Takes a Bite Out of DOMA, Pt 4

Last week’s article was the third in this series covering the court cases and government rulings that have been issued over the last several months. Today’s article, the last in the series, will consider migrating same-sex couples, i.e., couples who move from a state with one set of marriage equality laws to a state with a different set of marriage equality laws. With respect to marriage, all couples fall into 3 basic mindsets: lawfully married, intending to marry, or not reached the fence yet. For the sake of this article, we’ll also put states in 3 basic categories: friendly, unfriendly, and grey, such as Wisconsin. Lawfully married couples who migrate to an unfriendly state, will likely have state income and estate tax issues, presuming the state has an estate tax. If they have or plan to have children, a problem may emerge involving parental recognition and rights. Also, legal problems involving healthcare may arise, such as decision-making authority and visitation rights in medical emergencies. Lawfully married couples residing in friendly states should think long and hard before moving to unfriendly or grey jurisdictions. Married same-sex couples in a grey state should consider the worst-case scenario and take lessons from living somewhere like Alabama. One would think that the easiest advice to give married couples in a friendly state would be, “STAY PUT.” However, tax minimization and relationship recognition aren’t always the most important factors LGBT families face. Still, if all else is equal, they should STAY PUT. If a couple is engaged or intends to wed, they should consider all of the factors. Moving by itself is often a relationship destroyer, regardless of gender makeup. Add to that the stress of relationship recognition issues and stir in income tax burdens for good measure, and the couple may be divorced even before getting married. So great thought should be given to moving, especially if moving soon before or after the wedding. If a couple has yet to seriously consider marriage, they should travel together. If they begin considering marriage, they should move to a friendly state. A friendly hypothetical always helps to illustrate a point: Facts: Chris and Chaz marry in Iowa in 2010, move to Indiana, have a baby girl, Sarah, and Chris is killed in Indiana in 2012. Now Chaz’s attorney must file an estate tax return. Chris was also a transgender. Points to ponder: Was their marriage was valid? Iowa legalized same-sex marriage in 2009; they were married in 2010, so their marriage was lawful. The estate administration lawyer filed estate and income tax returns within 9 months of Chris’s death; can the income tax return be amended now? Yes; the return is inside the statute of limitations. Should the return be amended to reflect the marriage? Good question. It depends on potential advantages and disadvantages. Can the estate tax return, which was filed on June 21, 2012 be amended and should it be? Yes and it depends on a number of factors. Another hypo: If Indiana’s wrongful death statute required payment only to the spouse or children, does Chaz have standing to even claim? No, unless Chaz is willing to renounce their same-sex marriage which would be demeaning and a circumstance no one should have to endure. Also a final wrinkle is the fact that because Chris was the biological parent, Chaz would likely have to apply for guardianship before being able to act on behalf of baby Sarah as an heir. Though Windsor, Perry, and the government\’s guidance substantially increased marriage equality for LGBT couples, the decisions and rulings also resulted in more patches and landmines for migrating LGBT couples to navigate. Biting DOMA was good, but chewing the entire statute up would have been much more satisfying for those who want and deserve complete marriage equality. The IRS Bites DOMA Pt 1 | 2 | 3 | 4

Illinois Legislature Passed Marriage Equality Bill

Illinois shall become the 15th state to recognize same-sex marriage. When Governor Patrick Quinn signs the bill, LGBT couples may become lawfully married on June 1, 2014. See the live vote and Illinois Representative Greg Harris\’ remark, here.

Unraveling the Windsor Knot Part II

In Part I, we covered the U.S. v. Windsor (Windsor) analysis on the first component of standing: Article III requirements. Standing is the term of art used to discuss whether (1) parties have a case or controversy that the courts can hear, i.e., “Article III standing,” and (2) even if the court can hear the case, after considering other factors, the issue becomes should it, i.e., “prudential standing.” Here, in Part II, we continue looking at the issue of standing, specifically, satisfying the prudential principle. HINT: If you don\’t want to fight through the necessary legalese, bullet points are at the end. Having found Article III standing requirements met, the majority in Windsor, continued to prudential considerations. The Opinion used prudential considerations to address the BLAG’s standing. Before discussing and explaining what prudential standing is, Justice Scalia’s reference in his dissent to the majority’s use of prudential considerations is worth noting. Scalia argued that that majority sees the Article III requirements of adverseness as “prudential.” Recognizing how the Court uses the term “adverseness” in the Opinion, one can understand Scalia’s observation that the majority conflates adversity within the meaning of controversy for Article III standing and the adverseness involved with prudential standing. The majority cites Allen v. Wright (Allen) to explain the principle of prudential standing and offers Warth v. Seldin (Warth) as an example of how the limitations considered in the prudential principle can be overcome. And it is with these 2 cases that we’ll continue untying the Windsor knot of standing. Allen is a 1984 case where African-American families challenged the IRS’ standards for tax-exempt status as those standards were applied to private schools that allegedly engaged in racial discrimination. The Court in Allen, stated that the prudential strand of standing called for “judicially self-imposed limits on the exercise of federal jurisdiction, such as (1) the general prohibition on a litigant\’s raising another person\’s legal rights, (2) the rule barring adjudication of generalized grievances more appropriately addressed in the representative branches (a little ditty known as the “political question doctrine”), and (3) the requirement that a plaintiff\’s complaint fall within the zone of interests protected by the law invoked.” So this means that even if Article III standing is found, an appellate court does not have to hear a case if it is limited by one or more of the 3 factors listed above, i.e, if the Court is limited by prudential considerations. Ultimately, the Court ruled that the plaintiffs in Allen lacked Article III standing. Since the plaintiffs lacked Article III standing, whether the plaintiffs had prudential standing was irrelevant. The Court also made clear that an individual’s mere assertion of a right to have the federal government act in a way that is lawful is not sufficient to have a case heard. Warth, decided in 1975 – before Allen, involved taxpayers, residents, and a non-profit organization of Rochester County, New York that opposed zoning laws preventing low and moderate income families from being able to live in Penfield, NY. Proponents of the zoning laws were Penfield’s town, its Zoning Board, and Penfield’s Planning Commission members. The Court in Warth, first elaborated on Article III standing requirements and found them unmet but still considered prudential limitations, stating that “countervailing considerations … may outweigh concerns underlying the usual reluctance to exert judicial power.” So while Article III standing is required and prudential limits can veto Article III standing, certain factors can also veto prudential standing. In the same analysis structure as Warth and Allen, the Court in Windsor first considered Article III requirements, which the Court found satisfied. Then the Court considered the prudential limitations and found that sufficient “countervailing considerations” outweighed prudential limitations. This, Justice Scalia found, “incomprehensible.” But Scalia failed to mention that if the Court’s discussion in Windsor is viewed en toto, the Court is undoubtedly considering the 2 components of standing as separate components: Article III standing as explained in Lujan v. Defenders of Wildlife and (2) prudential limitations as explained in Warth and Allen. In fact, the majority stated outright, “The Court has kept these 2 strands separate: “Article III standing, which enforces the Constitution’s case-or-controversy requirement [citation omitted]; and prudential standing, which embodies “judicially self-imposed limits on the exercise of federal jurisdiction.” However, using the terminology generally ascribed to one principal as a way to explain how the other principle is applicable is assuredly confusing. And Justice Scalia\’s comments, in typical Scalia form, magnify the confusion. Forgetting Scalia’s commentary, the explanation in Warth clarifies the Windsor Opinion’s take on prudential limitations. Warth explains that if a plaintiff’s claim affects the legal rights of third parties, then prudential limits that might generally apply may be set aside. In other words, protecting the legal rights of persons outside the immediate parties involved might be more important than denying relief to one, as long as Article III requirements were met. In Windsor, Edie’s “win” wasn’t really a win because the IRS still refused to refund her money. So there was Article III controversy. Equally important, DOMA, a congressional statute negatively affected the rights of hundreds of thousands of others. It was this negative effect, which the majority called “adverseness,” that met the Warth test for overweighing the prudential considerations to which the Windsor majority referred in its prudential principle discussion. Justice Scalia chided the majority for calling \”adverseness\” an element of standing, when, in fact, per Chadha v. INS (Chadha) and Baker v. Carr (Baker), the adverseness that the majority refers to is provided to support an argument for prudential standing. Furthermore, Scalia projects the majority’s use of prudential standing in Chadha onto the majority’s use in Windsor, when it is not the use of prudential sanding as it was used in Chadha but the underlying factors of prudential standing that the majority used in Windsor. Again, by stepping back a few paces and analyzing the majority’s discussion as a whole, Baker also illuminates the issue and provides foundation for the Warth explanation. Baker