It’s Quite a Taxing Season…for Trusts

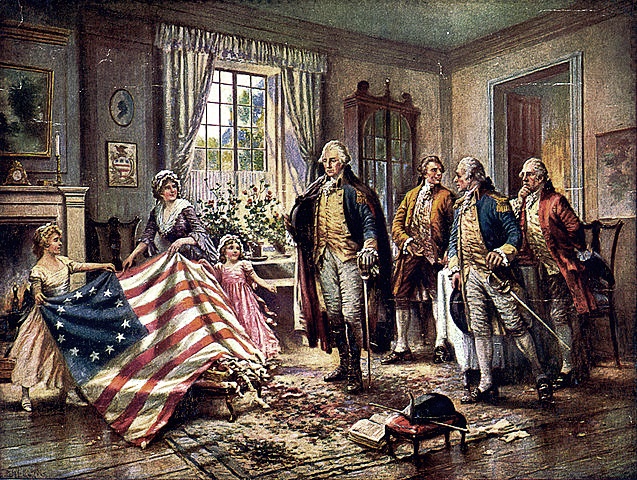

Everybody probably knows by now that in December, the Tax Cuts and Jobs Act (\”Tax Act”) was signed into law. Significant changes were made to the tax code, benefiting almost all United States citizens for at least one year and at least 1% of United States citizens for at least 7 years. In addition to the significant changes affecting individuals, the Tax Act also resulted in significant changes with respect to trust income. Before the Tax Act was signed, trust income that did not exceed $12,400 was not taxed by the Federal government. Trust income that did exceed $12,400 was taxed at the highest marginal rate, which was 39.6% in 2017. Now, with the Tax Act, the threshold has disappeared, meaning that all trust income not distributed in the year in which it was accrued is taxed at the highest marginal rate, which is now 37%. But before we get our knickers twisted, let’s parse this out a bit: Does this tax apply to all trusts? Good question. Generally, revocable living trusts are named such because the Grantor or Settlor – the person creating the trust – can change the trust whenever they want or even revoke the whole thing. Since the Grantor has this right, the assets in the trust, including all income, are considered to belong to the Grantor. So, because the assets and income belong to the Grantor, the income is generally taxed via the Grantor’s income tax return, the 1040, not an estate tax return, i.e., a 1041. Example 1 John Ross retained the firm, Hamilton & Associates to establish a revocable living trust for John, leaving his wife, Betsy, everything he owns upon his death; if Betsy dies before John, the assets will go to his nephew. John owns a house in Pennsylvania, life insurance from Lloyd’s of London, and a 49% share in Betsy’s flag-making business (Betsy’s Flags), which generates about $1,000 a year in income. After the JR Revocable Living Trust is established, John’s home is transferred to the trust because he doesn’t want Betsy to go through probate and, for some reason, he also transferred his 49% interest in Betsy’s Flags to the trust. However, the JR Revocable Living Trust is revocable and all assets still belong to John as Grantor and Trustee, so the trust pays no income tax because John pays the taxes … to the King. Example 2 John unfortunately dies while in service to his country. Upon his death, the JR Revocable Living Trust becomes irrevocable; it can’t be changed. And Betsy decides to leave John’s 49% interest in Betsy’s Flags in the trust and resigns as Trustee, letting Hamilton & Associates act as Trustee. The business is booming because several rogues, who were well acquainted with John, decided to start a war with the King and ordered a ton of flags from Betsy as a symbol of unity. So she’s quite happy with her 51% and really doesn\’t have time to administer the trust. John’s trust is now a “non-Grantor” trust because the Grantor is dead and the trust owns the assets. So any income generated by the 49% of Betsy’s Flags may be subject to the King’s income tax. Revocable Living Trust Tax 2017 2018 Income $1,000 $1,000 Federal Income Tax -0- -0- Irrevocable Trust Tax 2017 2018 Income $1,000 $1,000 Federal Income Tax -0- $ 370 Of course, one may distribute the income before the end of the year and deduct the payment from the trust’s tax return. However, scenarios exist where such distributions are neither desired nor advisable. Then what? Make sure your estate planning attorney, accountant, and financial advisor know and respect each other. Does this apply to all income? Another good question. One of the changes that the Tax Act also heralded in was a deduction for income earned by certain small businesses. Thus, the income generated by the 49% of Betsy’s Flags may actually be $296.00 instead of $370.00. What do you mean by certain small businesses? That’s a question for another article. So stay tuned…

Revisiting We ALL Do…

June is PRIDE month and to celebrate…all month long, we\’re revisiting the one of the most important decisions for our friends, family, and clients in the LGBTQ community: Obergefell v. Hodges, which gave the community marriage equality. To start things off, let\’s consider the 4 \”principles and traditions\” the Supreme Court of the United States used to justify its Opinion and, thus, marriage equality: \”Individual autonomy\” encompasses the right to decide who one will marry. See Loving v. Virginia. And in case you\’re wondering, \”individual autonomy\” is legalese that underpins the Declaration of Independence, the instrument that declares individuals free to pursue happiness. The union of marriage is a fundamental right because the intimacy of the marital union is unique and depriving same-sex couples from the recognition and protection of that intimacy is wrong. Marriage equality helps protect the emotional stability of children borne or adopted into same-sex marriages, by equalizing their families with heteronormative families. Marriage is one of the bases of America\’s social and legal order. Depriving same-sex couples from enjoying the benefits of marriage, which includes social stability, would be \”demeaning. Individuals must be free to pursue happiness. That happiness can be found in the remarkable closeness of the marital union. Generally, children are the fruit of marriages and children must be protected because they represent the future. Thus, marriage is a societal bedrock in which most adult individuals must be able to participate. Sounds simple, but it took us almost 50 years to get here.

A Mother\’s Love Doesn\’t Include Dad\’s New Wife

When a spouse dies, leaving behind a surviving spouse, children, and considerable assets, the surviving spouse should tread carefully with respect to estate planning instruments governing those assets. The 2016 Illinois Appellate case, Gwinn v. Gwinn, is a good example of this premise. Background Facts Ken Gwinn, Sr. and Betty were married with 4 children. In 2002, Betty established a trust, providing for Ken and their children. If Betty predeceased Ken, he was the designated Trustee, which meant that he had a fiduciary duty to abide by the terms of the trust. In 2009, Betty died. Her estate consisted of approximately $600,000 in liquid assets, a mortgage-free home in Illinois valued at approximately $750,000, and farm property. The terms of the trust gave Ken as much of the trust income as he wanted and a discretionary, albeit limited, amount of the trust principal. Upon Ken\’s death, the remaining trust assets were to be divided equally among the children. Two years after Betty’s death, Ken married Maria. After marrying Maria, Ken withdrew $475,000 from the trust to buy a home in Colorado for him and Maria. The Colorado home was titled solely in Maria\’s name and, thus, represented a gift from Ken Sr.’s late wife’s trust to his new wife. Needless to say, the kids were not pleased. So 3 of the 4 children filed a lawsuit against their father claiming breach of trust and breach of fiduciary duty because this gift was “extraordinary” (a legal term of art for gifts that are beyond the scope of intent) and went beyond trust terms. The lower court ruled in favor of the father and the children appealed. Appellate Court Analysis and Findings The Appellate Court agreed with the children, in finding that the trust was established for their benefit in addition to their father’s benefit. However, the Court also asserted that their father was the intended primary beneficiary during his lifetime and, as trustee, had broad discretion over distributing gifts from the trust to himself as beneficiary. Nevertheless, that discretion was not absolute. After considering the cardinal rule of the “intent of the testator or settlor,” specific limiting language in the trust, relevant case law, and persuasive legal treatises, the Court ruled that the discretion of gifting from the trust was limited to Betty’s descendants. Clearly, Maria was not Betty’s descendant. Additionally, even if Ken tried to cloak the gift to Maria in his own beneficiary status, the law precluded him, in his capacity as trustee, from increasing any beneficiary’s gift, including his own. The Illinois home was sufficient; taking $475,000 from the $600,000 corpus was deemed an “extraordinary gift.” The Court, therefore, found that the nearly half-million-dollar gift from Betty’s trust to Maria was not Betty’s intent (ya think?!) and, thus, Ken breached the trust terms. In breaching Betty’s trust terms, he also breached his fiduciary duty to all of the beneficiaries. This year, if your Valentine’s Day gift requires retitling, think twice, just in case.

Dead Clients Do Talk

The legal doctrine of “attorney-client privilege” has become a well-known phrase in the general public\’s lexicon. What the general public does not know is that the “privilege” generally lasts past death. Additionally, what is not understood, even by some attorneys is that the attorney-client privilege is called a “privilege” because the rule is actually an exception to our overarching duty to disclose facts to opposing counsel during disputes. Further unknown to the general public and most attorneys who do not practice in probate or estate administration is the exception to this exception: the “testamentary exception.” A case decided earlier this year, Eizenga v. Unity Christian School of Fulton, Illinois, involved a trust dispute and clarifies this rule and its exceptions for Illinois courts and attorneys. FACTS Walter Westendorf (Westendorf) established trust in 1997, which he amended 7 times before dying in 2013. Dale A. Eizenga (Eizenga) was designated as successor trustee when the trust was initially prepared and executed. In fact, Eizenga, in their capacity as successor trustee, was nearly the only relevant constant during the 16 years after the initial trust was prepared. In 2006, with the trust’s 3d amendment, Attorney Russell Holesinger (Holesinger) became a trustee and Unity Christian School of Fulton, Illinois (School), of which Holesinger also allegedly represented (read potential conflict of Interest), became 1 of 3 charitable remainder beneficiaries. Four amendments later, in 2012, Holesigner became the single second successor trustee and the School became the primary trust beneficiary. Eizenga filed a complaint against Holesinger, alleging “undue influence,\” and eventually sought Holesinger’s client documents. Holesinger refused and a lower court held Holesinger in contempt, and Holesinger appealed on the grounds of attorney-client privilege and the attorney work-product doctrine. As mentioned above, the attorney-client privilege generally lasts past death but for the testamentary exception that provides that in will contests, the attorney-client privilege cannot be invoked. Ironically, in the year of Westendorf’s death, another Illinois case, DeHart v. Dehart, reiterated the testamentary exception. Holesinger argued that this case, however, didn’t involve a will but instead involved a trust. ANALYSIS The Third District Appellate Court then examined the 2010 Graham Handbook of Illinois Evidence, other case law, and treatises addressing this issue and ruled that a will contest is not the only situation where the testamentary exception can be used. Next the court considered Holesinger’s attorney work-product argument. The attorney work-product doctrine is another exception to our disclosure duties, allowing attorneys to protect trial strategies and the mental impressions and opinions used to prepare for trial and establish said strategies. Because the documents in Holesinger’s files were not “created in preparation for any impending or pending litigation,” the Court held that Holesingers documents were not protected by the attorney work-product doctrine and, thus, affirmed the contempt finding by the lower court. The rationale is that a testator or trustmaker (settlor) would want their intent followed; so, if the attorney’s work-product was the only way to settle the dispute, then that information must be made available.

Think Again Before Opting In…

Recently Illinois enacted the Revised Uniform Fiduciary Access to Digital Assets Act (RUFADAA). The act allows individuals to designate fiduciaries access and control over their digital assets, e.g., Facebook, Gmail, LinkedIn, and other accounts without incurring criminal liability. A number of these platforms have tools that also allow you to name a fiduciary who will have access and control to that particular platform. Caution is advised because using said tools supersedes anything you put in writing, even Advanced Directives, wills, or trusts. How many of us have opted in to an agreement to forget about it later? Well, here, if you opt in and fail to continue updating, the love of your life when you were 23 who turned out to be a creep later, could actually gain control of your email account. It’s a stretch, but stranger things are happening in today’s world.

Update and Answer (?) to the Mendelson Mess…

***The most recent update*** The Illinois Trust Code finalized the rule about transferring property to trusts: Transfer of real property to trust. The transfer of real property to a trust requires a transfer of legal title to the trustee evidenced by a written instrument of conveyance. Update to First Post (Below). The bill was signed into law by Governor Rauner and becomes effective on January 1, 2017. BUT… questions, of course, are still unanswered, such as what is an \”interest\” in property for the purpose of this law. Well, we will continue to muddle through… First Post In October of 2015, we reported about a case that caused a slight sensation in the Illinois estate planning, title, and probate communities by providing that property need not be titled to a trust in order to be considered part of the trust estate. In response to the quiet uproar, on appeal, the court retraced some of the steps, but still left the issue about whether property needs to be titled to a trust in a questionable state. So, 2 Illinois legislators came to the rescue and introduced a bill in February 2016 requiring a title transfer to a trust and that the transfer be made via a written instrument, e.g., a deed to the trust. The measure, SB 2842, has passed both legislative chambers and is waiting for the Governor\’s signature. So stay tuned…

Illinois Court & AG Provides Life Preserver to Underwater Homeowners

In our probate practice, my firm occasionally provides services to individuals who inherited homes but can\’t afford the existing mortgage. Depending on the circumstances, we either assist the estate administrator in obtaining a loan modification or selling the home because a loan modification isn\’t feasible or wise. These circumstances usually arise because someone died intestate, i.e., without a will. Unfortunately, thousands of Illinois homeowners are still recovering from the sub-prime lending crisis and own homes that are “underwater,” where the balances on home mortgages exceed actual home values.Consequently, they seek loan modifications in order to prevent their homes from being foreclosed upon or to mitigate the stress on their budgets. Still, even in the wake of millions of people losing employment and homes, predatory subprime service providers haven\’t stopped. Nefarious actors can no longer offer subprime loans without impunity, so they now offer subprime loan modification services, instead. And to add insult to injury, in a recent Illinois case, wrongdoers argued that they could not be found liable for their misdeeds because they weren’t providing loans. Well, the Illinois Appellate Court in the First District disagreed. In People v. Wildermuth, the Illinois Attorney General sued lawyer and non-lawyer business partners who “aggressively” targeted African American and Latino communities to obtain clients who were faced with losing their homes. The pair falsely promised above-average loan modification results, while charging thousands of dollars for average results or worse. On behalf of Illinois citizens, the Illinois AG hauled the 2 into court on the grounds of reverse redlining, which the AG argued was a violation of the Illinois Human Rights Act. Redlining is the infamous discriminatory practice of refusing to provide mortgages in certain communities, such as minority communities. Reverse redlining is extending credit on unfair terms in “redlined” communities. The Illinois Human Rights Act protects citizens from such commercial discriminatory practices. The defendants in Wildermuth argued that because loan modifications didn’t involve new loans, i.e., they weren’t providing mortgages, that the reverse redlining theory didn’t apply to them. The Illinois Appellate Court, siding with the Illinois Attorney General, rejected their argument, stating that [R]everse redlining includes a broader scope of discriminatory practices involving real estate transactions and “target[ing] distressed African American and Latino homeowners … with regard to loan modification services and other actions including negotiation and procurement of loan modifications and short sales” was, included within that scope. So, Illinois citizens who suffer from predatory reverse redlining practices now have a remedy available when they fall victim to such practices. Lesson 1: The most basic of estate planning tools – life insurance that is sufficient to pay off the mortgage – would eliminate this issue for beneficiaries. Lesson 2: If it seems too good to be true, it usually is.

A Tale of Three Halves

Last fall, the Illinois Appellate Court, First District, Second Division, ruled on an interesting case of “first impression” involving our probate courts. The case, Harris v. Adame, involved incapacity and property ownership with respect to joint tenancy, an issue that is likely to appear more often over the next few years, given our aging population. Two brothers, Arnold and Arthur, once owned a home together in joint tenancy with rights of survivorship. In 2002, Arnold was in a car accident that left him in a coma. The court appointed a guardian of the person and estate for Arnold, who later recovered but kept the guardian. A few years later, in 2005, the guardian helped sell the brothers’ home to Jose Adame. The title packet included a form stipulating that Arnold was subject to guardianship. Less than a year later, Arnold died without a will, i.e., intestate, leaving his brother, Arthur, as his sole heir. In 2008, Cook County’s Office of the Public Guardian (OPG) was appointed guardian for Arthur. Next, in 2009, the OPG filed a citation to recover assets against Adame in an attempt to void the entire 2005 home sale. At trial, Adame argued that he was an innocent bona fide purchaser (BFP). OPG argued that the entire transaction was void because Arnold was incapacitated when he signed the conveyance, despite the fact that Arthur had capacity. Adame stated that he did not have legal notice of Arnold’s incapacity before the 2005 closing. Adame further argued that if the transaction was found void, then, because he was a BFP, he should to be reimbursed for the money he paid for the home. The trial court, in 2012, ruled in favor of the OPG on the issue of whether the entire transaction was void but decided not to rule on whether Adame was a BFP and, therefore entitled to reimbursement. Huh?! I know, right? Enter a timely and appropriate appeal by Adame questioning whether the aforementioned ruling was erroneous. The appellate court, rightfully, found just that. In particular, the court found that the transaction regarding Arnold’s joint tenancy interest was void, but the sale of Arthur’s was valid and Arnold’s estate now had Adame as a tenant in common. Essentially, Arthur wasn’t due Arnold’s entire estate only Arnold’s half. The court explained the rule that without a court order, neither a person who has been adjudicated disabled nor that person’s guardian can sell the disabled person’s property interest. Here, the guardian acted without leave of court, so the transaction selling Arnold’s interest was void. As a response, OPG argued that Arthur’s part of the transaction should be considered void because at the time of the trial, Arthur was also incapacitated. The court found the OPG’s timing was off and required proof that Arthur was incapacitated at the time of executing the sale contract. OPG provided no such proof, so Arthur’s transaction was not void. Not depending on the appellate court to get the law right, Adame argued that even if the entire transaction was deemed void, the after acquired title property doctrine should apply. The after acquired title property rule provides that a transaction may be found void if a ne’er do well tried selling a property – the entire enchilada – when they don’t have marketable title. However, only half of the interest was sold to Adame, so the doctrine was inapplicable in this case. Well, if only half of the transaction is valid – or void – depending on one’s perspective, then the entire transaction must be void, OPG stated, to which the court responded with a first-year law school lesson in joint tenancy. First, the court again reminded OPG that, in law, a party needs evidence to support one’s arguments, and OPG provided no evidence, i.e., case or statutory law providing that an entire transaction is void simply because one party’s joint tenancy interest was not conveyed. On the contrary, the court provided ample support for the rule that one tenant can server joint tenancy without the other tenant’s knowledge or consent, transforming the joint tenancy into a tenancy-in-common with the new interest holder. And Arthur did just that: he created a tenancy-in-common relationship between Arnold’s estate and Adame. Now, to ensure that all parties were on the same page, the court then explained the fact that when a party severs joint tenancy, even if the action was a mistake, the agreement severing the joint tenancy is still enforceable. Thus, the appellate court found Adame owned ½ interest in the home and further instructed the trial court to determine whether, since Adame paid consideration for an entire house but only obtained ½ interest, Adame should be reimbursed for the other ½ of the consideration paid. Seems like an easy determination…

No Deed Needed to Transfer Property…With a Valid Trust

[vc_row type=\”in_container\” full_screen_row_position=\”middle\” column_margin=\”default\” column_direction=\”default\” column_direction_tablet=\”default\” column_direction_phone=\”default\” scene_position=\”center\” text_color=\”dark\” text_align=\”left\” row_border_radius=\”none\” row_border_radius_applies=\”bg\” overflow=\”visible\” overlay_strength=\”0.3\” gradient_direction=\”left_to_right\” shape_divider_position=\”bottom\” bg_image_animation=\”none\”][vc_column column_padding=\”no-extra-padding\” column_padding_tablet=\”inherit\” column_padding_phone=\”inherit\” column_padding_position=\”all\” column_element_spacing=\”default\” background_color_opacity=\”1\” background_hover_color_opacity=\”1\” column_shadow=\”none\” column_border_radius=\”none\” column_link_target=\”_self\” column_position=\”default\” gradient_direction=\”left_to_right\” overlay_strength=\”0.3\” width=\”1/1\” tablet_width_inherit=\”default\” tablet_text_alignment=\”default\” phone_text_alignment=\”default\” animation_type=\”default\” bg_image_animation=\”none\” border_type=\”simple\” column_border_width=\”none\” column_border_style=\”solid\”][vc_column_text]***This issue has an important update.*** In September, a ruling by the Illinois Second District Appellate Court sent small shockwaves throughout the Illinois estate planning community. The case, The Estate of Mendelson v. Mendelson, presented the Court with the question of whether real property transferred via a trust without recording the transfer is a valid transfer. To preserve legal chain of title, real estate transfers in Illinois must be recorded with the appropriate county recorder of deeds office. Additionally, it is well-settled law that a transfer to a trust is valid without recording a deed if one later uses a pour-over will via probate. Mendelson questions the need for a pour-over will or recording before death. Timeline & Facts 2005: The decedent, Diane, signed a deed transferring the home she owned outright into joint tenancy with one of her 4 sons, Michael. The deed wasn’t recorded. 2006: Diane established a trust and executed another deed that, upon her death, divided the home among the 4 sons. The trust and that deed were recorded. 2011: Diane established a new trust, completely revoking the 2006 trust and designated Michael, once again, as the sole beneficiary of the home and successor trustee to Diane. On October 1, Diane died leaving her sons and no surviving spouse. A few days later, Michael recorded the 2005 deed and the 2011 trust. In November, the legal battle begins. 2014: A trial court ruled that the 2006 trust was valid and, thus, the home was to be shared by the 4 sons. Michael appealed. Battle Theories The Estate (representing the 3 sons) made 2 arguments: (1) The 2006 trust was valid; or (2) the 2011 trust was valid, revoking the 2006 trust but because the 2005 deed was recorded post-death, the home was probate property subject to Illinois laws of intestacy. Illinois descent and distribution laws state that if a property is subject to probate whereby there was no valid will in place and no surviving spouse, the property shall be divided evenly between descendants. The Final Ruling The Appellate Court found that the 2005 deed was invalid because it was not properly delivered to Michael; it wasn\’t Diane’s intent to transfer the property to Michael then. The Court also found that the 2011 trust revoked the 2006 trust, the revocation meeting the requirements for revoking a trust. In so finding, the Court fleshed out the valid requirements of a trust: (1) intent to create a trust; (2) defined trust assets; (3) stated beneficiaries; (4) designated trustee; (5) stated purpose and administration provisions; and (6) delivery of property to trustee. Mendelson’s ruling hinged on number 6: whether the property of the trust – the home – was delivered to the trustee. No Illinois law existed before this case to answer whether assets needed to be formally transferred to a trust. In this case, the trust was a revocable living trust, so the Court reasoned that because the trustee of a revocable living trust already owns the property, no formal transfer was necessary. Therefore, Mendelson’s final ruling, which is arguably narrow, is that a “[trustmaker] who declares a trust naming herself a trustee is not required to separately and formally transfer the designated property into the trust.” Accordingly, Michael’s actions after Diane’ death – recording the deed and trust – were legally valid. The ruling caused shockwaves for 2 primary reasons: (1) Titling property to trusts is a revenue stream for title companies and municipalities; and more importantly, (2) if real estate is assigned to trustees without recording the transfer with municipalities, then the chain of title listed with the recorder of deeds indices will eventually become fraught with errors, leading to increased litigation over property rights. Nevertheless, for now, Mendelson is the law in Illinois.[/vc_column_text][/vc_column][/vc_row]

The Wait Is Over: All Americans Are Free to Wed

In a plurality Opinion authored by Justice Anthony Kennedy, today, June 26, 2015, the United States Supreme Court ruled in favor of marriage equality for the country. Removing any doubt that states that did not support same-sex marriage would be able to continue to discriminate against LGBTQ couples, in Obergefell v. Hodges, the Court provided that states must (1) recognize same-sex marriages that were lawfully performed, even if outside of their states and (2) states must issue marriage licenses to same-sex couples. Accordingly, if a state did not recognize or did not provide for same-sex marriages before, it must do so now. The Court’s rationale for its ruling considered 4 principles: (1) personal choice; (2) the status of marriage; (3) the protection of children; and (4) the stability of America’s social order. This 27-page Decision downloaded here, followed by 76 pages of dissent, is based on the fundamental right to marry, which is undergirded by the Equal Protection Clause and the Due Process Clause of the Fourteenth Amendment of the U.S. Constitution. The holding is as eloquent as it is just: “No union is more profound than marriage, for it embodies the highest ideals of love, fidelity, devotion, sacrifice, and family. In forming a marital union, two people become something greater than once they were. As some of the petitioners in these cases demonstrate, marriage embodies a love that may endure even past death. It would misunderstand these men and women to say they disrespect the idea of marriage. Their plea is that they do respect it, respect it so deeply that they seek to find its fulfillment for themselves. Their hope is not to be condemned to live in loneliness, excluded from one of civilization’s oldest institutions. They ask for equal dignity in the eyes of the law. The Constitution grants them that right.” The 62 pages of dissent begins with Chief Justice Roberts, who argues that the acceptance of marriage equality will be much more difficult to achieve because of those who were and are against marriage equality will be chaffed by the fact that their opinions are now irrelevant in the eyes of the law. He analogizes the coming “cloud” over marriage equality to that of the cloud over racial equality. It is a point well taken but, respectfully, the Chief Justice is ignoring the fact that a long-standing responsibility of the Court is to provide equality in the law where inequality exists for those who have been marginalized. The fight for social recognition, of course, is not over. However, being equal with respect to the law does not require social acceptance. Justice Scalia argues that America’s democracy is now in jeopardy. His dissent is not unusual in that he disagrees with the Opinion on the grounds of Constitutional literalism and states’ rights. It is unusual in that he equates the Court with God but then states that the Court, or the 5 activist judges comprising the majority in this Decision, is acting out of hubris. His opinion that 135 years of precedent has been overturned is quite remarkable, itself. Justice Thomas is also in his usual form, reiterating Justice Scalia’s remarks but offering for good measure a nod to the Magna Carta that just celebrated its 800th anniversary and the philosopher John Locke. The final and most brief dissent, authored by Justice Alito, is a rejection of the new norm or “orthodoxy” as J. Alito terms it. Notwithstanding the dissents, as C.J. Roberts stated, the argument – at least legally – is over; and to quote J. Kenned, “It is so ordered.” We do.