Give Me Your Family and Your Money

Estate planning attorneys help clients manage the 2 most important aspects of our clients’ lives: their families and their money. This means we must know as much as possible about our clients, more than almost anyone. A friend recently chuckled when I told them that if they want to be my estate planning client, then they need to talk to me as they would their doctor and then tell me what their doctor reported; talk to me like they would their tax accountant and then give me copies of their tax returns; talk to me like they would their financial planner and then give me copies of all of their financial records; talk to be about their children, siblings, partners, and parents and then tell me what they don’t want them to know; and, finally, give me the complete contact information for each one of the persons we just discussed so that I can verify, within the bounds of attorney-client privilege, HIPAA, and other fiduciary rules, the information provided with each person. And THAT is why to consider preparing a Last Will and Testament or a Trust as a DIY task is NOT funny … Unless you’re a doctor who can diagnose their own maladies, an estate planning attorney who is also a tax accountant, and a Certified Financial Planner with licenses to buy all the financial products available to amass wealth, AND you have no loved ones or potential beneficiaries. And THAT is why having a credible, experienced estate planning attorney is important for 99.9% of adults… One of our instruments is called a Trust for a reason. No joke.

New Laws Approaching Fast

Summer has ended for most families with children and we thought about this and other family dynamics in our most recent newsletter. However, the summer didn\’t stop Illinois Governor Pritzker from approving several laws that will affect families and businesses in the coming months. Here\’s a few that you may find interesting: The Illinois Trust Code, effective January 1, 2020, aligns Illinois with states that have adopted or established their own version of the Uniform Trust Code. Meaning for you: As you and your family move among the states, your estate plan may not need much revision. Assault or battery of an elderly person results in a loss of inheritance, effective January 1, 2020. Meaning for you: Nothing, we hope. Recreational cannabis will be legal in Illinois, effective January 1, 2020. Meaning for you: If you will partake or endeavor commercially, remember it is still against the law, federally, Uniform Partition of Heirs Property Act, effective January 1, 2020. Meaning for you: If you inherit property with someone else as a co-tenant and y\’all can\’t get along, the property can be sold without mutual agreement. Department of Public Health Powers and Duties Law amended to allow a feasibility study for a state repository for Healthcare Powers of Attorney and other medical Advanced Directives. Meaning for you: Unclear; these are your taxpayer dollars going to a study to determine if your medical information should be held by the State. Those are the headliners that we found relevant to our clients and associates. We\’ll be providing deeper analyses of these issues and others as the laws become effective and part of our society\’s fabric.

Was I Just Disinherited?

As an estate planning and estate administration attorney firm, we routinely get questions when an individual’s loved one has died and they believe they are owed an inheritance. Perhaps they heard their loved one mention a Last Will and Testament or a Revocable Trust or, worse, a loved one died and because the individual is the only reviving heir, they are confused when they can’t obtain a second mortgage. Leaving the latter situation for another time, below are a few common questions we are often asked. Q: How will I know if I\’m a beneficiary of my mother’s Will or Trust?A: The Executor or Trustee must contact you; it’s the law. Q: My grandmother died a year ago and had a Trust. My uncle, the Trustee, won’t tell me anything. Is there anything I can do?A: Your grandmother may have left everything to her children (your uncle and parent) equally and not per stirpes, in which case, you may not be entitled to know anything. However, if your parent, who was your grandmother’s child, predeceased your grandmother, you could seek to probate your grandmother’s estate. Q: My father died and his Trust left everything to my stepmother, and upon her death, me and my siblings will inherit. Can’t we get anything now?A: If the terms of the trust are validly provided as you stated, you can’t receive anything now. You may receive inheritance from life insurance or bank accounts whereby your were the designated beneficiary but that’s all. A marital Trust, which is what this may be, generally provides all income and complete discretionary distributions of all principal to the surviving spouse. In other words, your stepmother can spend up or sell all trust assets, leaving you and your siblings with nothing. Be nice to your stepmom. Q: My sibling mentioned her Trust before dying a month ago and we can\’t find it among her papers. What she me and our other brother do?A: If she had a lawyer, contact the lawyer. If she was a regular client at a bank, maybe she has a safe deposit box, which will require a Small Estate Affidavit to open; but it could be in there. If you can’t find anything in 90 days, click here to learn about probate. Feel free to contact us if you\’ve got a question.

It’s Quite a Taxing Season…for Trusts

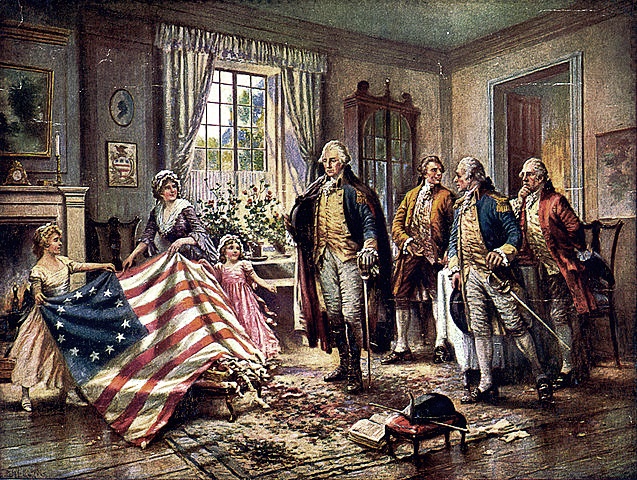

Everybody probably knows by now that in December, the Tax Cuts and Jobs Act (\”Tax Act”) was signed into law. Significant changes were made to the tax code, benefiting almost all United States citizens for at least one year and at least 1% of United States citizens for at least 7 years. In addition to the significant changes affecting individuals, the Tax Act also resulted in significant changes with respect to trust income. Before the Tax Act was signed, trust income that did not exceed $12,400 was not taxed by the Federal government. Trust income that did exceed $12,400 was taxed at the highest marginal rate, which was 39.6% in 2017. Now, with the Tax Act, the threshold has disappeared, meaning that all trust income not distributed in the year in which it was accrued is taxed at the highest marginal rate, which is now 37%. But before we get our knickers twisted, let’s parse this out a bit: Does this tax apply to all trusts? Good question. Generally, revocable living trusts are named such because the Grantor or Settlor – the person creating the trust – can change the trust whenever they want or even revoke the whole thing. Since the Grantor has this right, the assets in the trust, including all income, are considered to belong to the Grantor. So, because the assets and income belong to the Grantor, the income is generally taxed via the Grantor’s income tax return, the 1040, not an estate tax return, i.e., a 1041. Example 1 John Ross retained the firm, Hamilton & Associates to establish a revocable living trust for John, leaving his wife, Betsy, everything he owns upon his death; if Betsy dies before John, the assets will go to his nephew. John owns a house in Pennsylvania, life insurance from Lloyd’s of London, and a 49% share in Betsy’s flag-making business (Betsy’s Flags), which generates about $1,000 a year in income. After the JR Revocable Living Trust is established, John’s home is transferred to the trust because he doesn’t want Betsy to go through probate and, for some reason, he also transferred his 49% interest in Betsy’s Flags to the trust. However, the JR Revocable Living Trust is revocable and all assets still belong to John as Grantor and Trustee, so the trust pays no income tax because John pays the taxes … to the King. Example 2 John unfortunately dies while in service to his country. Upon his death, the JR Revocable Living Trust becomes irrevocable; it can’t be changed. And Betsy decides to leave John’s 49% interest in Betsy’s Flags in the trust and resigns as Trustee, letting Hamilton & Associates act as Trustee. The business is booming because several rogues, who were well acquainted with John, decided to start a war with the King and ordered a ton of flags from Betsy as a symbol of unity. So she’s quite happy with her 51% and really doesn\’t have time to administer the trust. John’s trust is now a “non-Grantor” trust because the Grantor is dead and the trust owns the assets. So any income generated by the 49% of Betsy’s Flags may be subject to the King’s income tax. Revocable Living Trust Tax 2017 2018 Income $1,000 $1,000 Federal Income Tax -0- -0- Irrevocable Trust Tax 2017 2018 Income $1,000 $1,000 Federal Income Tax -0- $ 370 Of course, one may distribute the income before the end of the year and deduct the payment from the trust’s tax return. However, scenarios exist where such distributions are neither desired nor advisable. Then what? Make sure your estate planning attorney, accountant, and financial advisor know and respect each other. Does this apply to all income? Another good question. One of the changes that the Tax Act also heralded in was a deduction for income earned by certain small businesses. Thus, the income generated by the 49% of Betsy’s Flags may actually be $296.00 instead of $370.00. What do you mean by certain small businesses? That’s a question for another article. So stay tuned…

The Other 1%*

In the beginning of my career as an estate planner, like many Americans, I was constantly bombarded with news about the “one-percenters” – Americans who were the wealthiest of our population. With respect to estate planning, these folks had all kinds of complex trusts – GRATs, SLATs, DAPTs, CRATs, pick your trust acronym – to suit their particular needs. The one-percenters have so much wealth that in addition to lack of anxiety over financial matters, future generations of their families generally share this liberating lack of anxiety. Because our community beat the drum so loudly in an effort to assist the one-percenters in preserving their wealth, when asked what I did for a living invariably, upon hearing the response, someone would say: “Oh, you help the one-percenters; that’s not me. I’ll call you when I get there.” Yet, as an estate administrator, I also know that those who rejected the notion of needing planning help because they weren’t a one-percenter were gravely (pun intended) mistaken. Folks in the 99% category are adversely affected in a much greater proportion by loss of wealth or earning potential than the one-percenters who experience loss of wealth. On a dramatic scale, a one-percenter who loses significant wealth may go from a McMansion to a bungalow; a 99%r may go from a bungalow to a homeless shelter. I witness it nearly every time I step into probate court. Consider this example: Ben owns thousands of acres that includes a successful dairy farm, a few oil wells, a couple of streams, and farmland that produces various grains. Ben’s family has not had any financial worries in more than a century; so, yes, they’re in the one-percenters. Several years ago, Ben assumed running the family “business” from his mother and when he did so, he spent about $100,000 in estate, retirement, and business planning fees. He now spends a nominal fraction of that annually between the 3. Ben’s plan safeguards the land and income it produces, and the initial fee structure represented less than 1% of the value of his family’s wealth. Now, consider your own wealth or your family’s wealth, whether you’re at the beginning, middle, or end of your “peak” wealth accumulation period. Next, consider your health. If you were to become seriously ill, is your earning potential, current capacity, or nest egg protected? Just like Ben, the one-percenter, you too, can use less than one-percent of your wealth or earning potential to protect what you have earned or your capacity; you can safeguard you and your loved ones and even future generations with just 1% of your family\’s annual earnings. After the popularity whirling about the one-percenters cooled, we started hearing a lot about “leaning in.” I recommend we zoom in. Focusing on the one-percenters while fun is also futile; instead, focus on the other one-percent – the 1% of you that can 100% help your family. *Credit for the title goes to my dear colleague, Stephen L. Hoffman.

Dead Clients Do Talk

The legal doctrine of “attorney-client privilege” has become a well-known phrase in the general public\’s lexicon. What the general public does not know is that the “privilege” generally lasts past death. Additionally, what is not understood, even by some attorneys is that the attorney-client privilege is called a “privilege” because the rule is actually an exception to our overarching duty to disclose facts to opposing counsel during disputes. Further unknown to the general public and most attorneys who do not practice in probate or estate administration is the exception to this exception: the “testamentary exception.” A case decided earlier this year, Eizenga v. Unity Christian School of Fulton, Illinois, involved a trust dispute and clarifies this rule and its exceptions for Illinois courts and attorneys. FACTS Walter Westendorf (Westendorf) established trust in 1997, which he amended 7 times before dying in 2013. Dale A. Eizenga (Eizenga) was designated as successor trustee when the trust was initially prepared and executed. In fact, Eizenga, in their capacity as successor trustee, was nearly the only relevant constant during the 16 years after the initial trust was prepared. In 2006, with the trust’s 3d amendment, Attorney Russell Holesinger (Holesinger) became a trustee and Unity Christian School of Fulton, Illinois (School), of which Holesinger also allegedly represented (read potential conflict of Interest), became 1 of 3 charitable remainder beneficiaries. Four amendments later, in 2012, Holesigner became the single second successor trustee and the School became the primary trust beneficiary. Eizenga filed a complaint against Holesinger, alleging “undue influence,\” and eventually sought Holesinger’s client documents. Holesinger refused and a lower court held Holesinger in contempt, and Holesinger appealed on the grounds of attorney-client privilege and the attorney work-product doctrine. As mentioned above, the attorney-client privilege generally lasts past death but for the testamentary exception that provides that in will contests, the attorney-client privilege cannot be invoked. Ironically, in the year of Westendorf’s death, another Illinois case, DeHart v. Dehart, reiterated the testamentary exception. Holesinger argued that this case, however, didn’t involve a will but instead involved a trust. ANALYSIS The Third District Appellate Court then examined the 2010 Graham Handbook of Illinois Evidence, other case law, and treatises addressing this issue and ruled that a will contest is not the only situation where the testamentary exception can be used. Next the court considered Holesinger’s attorney work-product argument. The attorney work-product doctrine is another exception to our disclosure duties, allowing attorneys to protect trial strategies and the mental impressions and opinions used to prepare for trial and establish said strategies. Because the documents in Holesinger’s files were not “created in preparation for any impending or pending litigation,” the Court held that Holesingers documents were not protected by the attorney work-product doctrine and, thus, affirmed the contempt finding by the lower court. The rationale is that a testator or trustmaker (settlor) would want their intent followed; so, if the attorney’s work-product was the only way to settle the dispute, then that information must be made available.

No Deed Needed to Transfer Property…With a Valid Trust

[vc_row type=\”in_container\” full_screen_row_position=\”middle\” column_margin=\”default\” column_direction=\”default\” column_direction_tablet=\”default\” column_direction_phone=\”default\” scene_position=\”center\” text_color=\”dark\” text_align=\”left\” row_border_radius=\”none\” row_border_radius_applies=\”bg\” overflow=\”visible\” overlay_strength=\”0.3\” gradient_direction=\”left_to_right\” shape_divider_position=\”bottom\” bg_image_animation=\”none\”][vc_column column_padding=\”no-extra-padding\” column_padding_tablet=\”inherit\” column_padding_phone=\”inherit\” column_padding_position=\”all\” column_element_spacing=\”default\” background_color_opacity=\”1\” background_hover_color_opacity=\”1\” column_shadow=\”none\” column_border_radius=\”none\” column_link_target=\”_self\” column_position=\”default\” gradient_direction=\”left_to_right\” overlay_strength=\”0.3\” width=\”1/1\” tablet_width_inherit=\”default\” tablet_text_alignment=\”default\” phone_text_alignment=\”default\” animation_type=\”default\” bg_image_animation=\”none\” border_type=\”simple\” column_border_width=\”none\” column_border_style=\”solid\”][vc_column_text]***This issue has an important update.*** In September, a ruling by the Illinois Second District Appellate Court sent small shockwaves throughout the Illinois estate planning community. The case, The Estate of Mendelson v. Mendelson, presented the Court with the question of whether real property transferred via a trust without recording the transfer is a valid transfer. To preserve legal chain of title, real estate transfers in Illinois must be recorded with the appropriate county recorder of deeds office. Additionally, it is well-settled law that a transfer to a trust is valid without recording a deed if one later uses a pour-over will via probate. Mendelson questions the need for a pour-over will or recording before death. Timeline & Facts 2005: The decedent, Diane, signed a deed transferring the home she owned outright into joint tenancy with one of her 4 sons, Michael. The deed wasn’t recorded. 2006: Diane established a trust and executed another deed that, upon her death, divided the home among the 4 sons. The trust and that deed were recorded. 2011: Diane established a new trust, completely revoking the 2006 trust and designated Michael, once again, as the sole beneficiary of the home and successor trustee to Diane. On October 1, Diane died leaving her sons and no surviving spouse. A few days later, Michael recorded the 2005 deed and the 2011 trust. In November, the legal battle begins. 2014: A trial court ruled that the 2006 trust was valid and, thus, the home was to be shared by the 4 sons. Michael appealed. Battle Theories The Estate (representing the 3 sons) made 2 arguments: (1) The 2006 trust was valid; or (2) the 2011 trust was valid, revoking the 2006 trust but because the 2005 deed was recorded post-death, the home was probate property subject to Illinois laws of intestacy. Illinois descent and distribution laws state that if a property is subject to probate whereby there was no valid will in place and no surviving spouse, the property shall be divided evenly between descendants. The Final Ruling The Appellate Court found that the 2005 deed was invalid because it was not properly delivered to Michael; it wasn\’t Diane’s intent to transfer the property to Michael then. The Court also found that the 2011 trust revoked the 2006 trust, the revocation meeting the requirements for revoking a trust. In so finding, the Court fleshed out the valid requirements of a trust: (1) intent to create a trust; (2) defined trust assets; (3) stated beneficiaries; (4) designated trustee; (5) stated purpose and administration provisions; and (6) delivery of property to trustee. Mendelson’s ruling hinged on number 6: whether the property of the trust – the home – was delivered to the trustee. No Illinois law existed before this case to answer whether assets needed to be formally transferred to a trust. In this case, the trust was a revocable living trust, so the Court reasoned that because the trustee of a revocable living trust already owns the property, no formal transfer was necessary. Therefore, Mendelson’s final ruling, which is arguably narrow, is that a “[trustmaker] who declares a trust naming herself a trustee is not required to separately and formally transfer the designated property into the trust.” Accordingly, Michael’s actions after Diane’ death – recording the deed and trust – were legally valid. The ruling caused shockwaves for 2 primary reasons: (1) Titling property to trusts is a revenue stream for title companies and municipalities; and more importantly, (2) if real estate is assigned to trustees without recording the transfer with municipalities, then the chain of title listed with the recorder of deeds indices will eventually become fraught with errors, leading to increased litigation over property rights. Nevertheless, for now, Mendelson is the law in Illinois.[/vc_column_text][/vc_column][/vc_row]

The Slayer Statute in the News Again

Teen allegedly murders mom; mom was affluent; teen charged with murder; teen is poor but retains defense team; asks trustee, who is teen\’s brother for legal expense funds; brother says no; through lawyers teen sues estate to pay legal defense fees. Question: Will teen prevail in lawsuit? According to Illinois\’s slayer statute, it depends. The plain language of the statute provides that one cannot profit from causing another person\’s death: A person who intentionally and unjustifiably causes the death of another shall not receive any property, benefit, or other interest by reason of the death, whether as heir, legatee, beneficiary, joint tenant, survivor, appointee or in any other capacity and whether the property, benefit, or other interest passes pursuant to any form of title registration, testamentary or nontestamentary instrument, intestacy, renunciation, or any other circumstance. The property, benefit, or other interest shall pass as if the person causing the death died before the decedent, provided that with respect to joint tenancy property the interest possessed prior to the death by the person causing the death shall not be However, the operative word in the statute is \”causes.\” This means that the person must be first convicted of knowingly, without legal justification, killing another human being. Ms. Mack hasn\’t been convicted yet. So what may happen? The court may tell defense to bill but don\’t even think about collecting until the jury is in. The next issue is then whether Ms. Mack be able to keep this same defense team.

A Letter and Recipe for Your Family\’s Long-Term Health

Dear Family, Friends, and Folks Like Me, Last weekend I was able to release my culinary skills on a lovely group of friends and it was so delightful, I thought I\’d write a letter capturing that theme. So, I’m writing to ask that you join me in promising not to take the path of so many of our elders in creating a disastrous family meal and that you follow a healthier recipe. A friend recently heard the term, “Sandwich Generation,” for the first time. He asked me if it was because our peers grew up with Wonder Bread. Smiling, I responded, “Not quite.” I explained that the term is not because of what we ate as kids but because of what many of us are experiencing as adults. If we step back and look at the generations of family to whom we are connected, most of us will have children, whether our own or nieces, nephews, or cousins, on one side and our parents or grandparents, and sometimes both on the other side. Accordingly, we will have loved ones looking to us for care and assistance from both sides. Considering “sandwiches,” if our loved ones are the bread, then what are we? Yes. We are the stuff in the middle – peanut butter and jelly, roast beef, turkey – and because some of our elders didn’t understand or didn’t receive lessons on how to prepare a healthy, life-sustaining, family meal, many of us are starting to feel more like seamy meat-by-product instead of the tasty Portobello mushroom. So, Dear Family, Friends, and Folks Like Me, take a couple of seconds to jot down this recipe for a healthy family meal: Ingredients 1 lb of good health insurance, which may include long-term care insurance because, despite our denial, we will get old and most of us will live longer than anticipated 2 tbsps of life insurance: one for income replacement and the other for bills and larger items that must be or should be paid, such as mortgages and college educations 2-4 gallons of consistent retirement savings – about 1 cup per year 2 tbsps of powers of attorney: one for financial issues and one for healthcare issues; and 1 Will: so you can decide on who gets what and not the courts. Preparation Combine all of the above with 3-4 trusted and honorable fiduciaries, covered by a trust if you own a home, and stir occasionally with a very good financial planner and CPA. Cooking Time Then let sit for about a year, or taking it out more frequently to revisit growing family needs basis. Let’s make a conscious promise that instead of making our children feel like overdone and gamy sandwich meat, we show them that they are part of a healthy, hearty stew from which everyone can benefit and be satisfied in the long run. A votre sante! Max

The IRS Takes a Bite Out of DOMA, Part 1

Recently, on a panel at a Chicago Bar Association’s Trust Committee meeting, I discussed tax and estate planning issues in light of the U.S. Supreme Court case, U.S. v. Windsor and the new federal agency rules on same-sex married couples. This article is Part 1 of a 4-part series from that discussion. Before Windsor, preparing estate plans for same-sex couples was often complex, especially if the couples were married, in a Civil Union, Registered Domestic Partners, or long-time partners in a substantially similar relationship when compared to opposite-sex married couples. The so-called Defense of Marriage Act (DOMA) compounded the complexity by prohibiting federal agencies from recognizing the couples and spurring states to create mini-DOMAs. The disparate treatment forced same-sex couples with sizable estates to literally give away large portions of their assets, either in the form of charitable donations or tax payments. However, even couples with very modest estates were required to have powers of attorney and related directives prepared with painstaking creativity. Finally, when most couples, despite their estate\’s size, asked why their planning was so complex, they listened to how their families were “different” and warnings, such as “though a valid legal document, don’t use this in Texas,” or “don’t have an accident in Will County.” Generally, creating a joint will for same-sex couples, even those lawfully married, was and still is a risky undertaking because the relationship was not federally recognized and is not recognized by a majority of states. Even in states such as Illinois where Civil Union couples have the same benefits of as opposite-sex married couples, including testamentary benefit, some counties are nonetheless hostile. Thus, a surviving partner presenting a joint will in a probate court of such a county might face an uphill battle. Setting the issue of joint wills aside, but considering will provisions, the unequal treatment of same-sex couples required careful tailoring of what could be boilerplate provisions in wills for opposite-sex married couples. The tailoring and special provisions include: Family Article; A statement of intent; Definitions providing expansive and inclusive meanings for “child,” “partner,” Civil Union, Registered Domestic partner, spouse, next of kin, and marriage; Prospective guardianship and successor guardianship language; A no-contest provision; A pour-over provision; A definitive choice of law statement; A notary seal, though notarizing a will is not required in Illinois; and more. I mentioned the pour-over provision because even if the family is of modest means, contentious behavior from another family member would warrant a trust also be prepared as a second line of defense for fighting contention. This is not the case for married opposite-sex couples because the opposite-sex surviving spouse would, at least initially, have the law squarely on his or her side as a second line of defense. If a same-sex couple of modest means could not afford a trust, and some could not, then they would try to plan for transferring all assets by operation of law and hope that a family member with a small estate affidavit didn’t show up to claim for the forgotten bank account. For the sake of example, let’s say a trust was prepared. One positive sliver for practitioners and our clients was that we didn’t have to worry about the reciprocal trust doctrine or unlimited marital deduction (IRC 2056) issues. But that was just the point: Because of the unfair treatment by the government, our clients could not take advantage of the unlimited marital deduction, federal QTIP elections, gift-splitting, or portability. So provisions had to be drafted carefully to work-around this lack of spousal gifting benefits. Additional provisions and mechanisms for trusts included: Expressly prohibiting a contentious family member from acting in a fiduciary capacity Providing the trustee and successor trustee with HIPAA rights; Providing the trustee with authority to take reasonable steps to ensure transfer of retirement assets to the same-sex spouse or partner result in the least adverse tax implications for the surviving spouse or partner; Using life insurance trusts; and Thoughtfully and diligently considering the “common disaster” provision. As mentioned earlier, other directives, agreements, and documents were and still are critical. These instruments include HIPAA release forms; a hospital visitation authorization form; reciprocal powers of attorney with 2 disinterested witnesses per instrument and with each instrument notarized but with a warning about describing the relationship depending on the county (imagine – having to hide your relationship in case of a medical emergency in order to ensure your spouse’s medical treatment!); reciprocal living wills; and reciprocal Illinois Mental Health Treatment Declarations. Many colleagues might say that possessing all of these documents would be redundant, and they would be correct…with respect to opposite-sex married couples. However, for same-sex married couples possessing all of these documents is evidence that strongly supports the commitment between the 2 individuals and, thus, their testamentary intent. Thankfully, Windsor and the subsequent flurry of guidance from government agencies took a bite out of DOMA; and stay tuned for Part 2 of this series, which will cover that guidance. One nation with justice and liberty for all… The IRS Bites DOMA, Pt 1 | 2 | 3 | 4