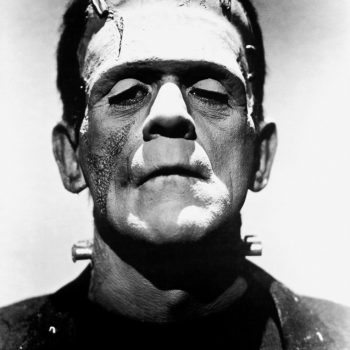

Probate Horrors: Not All Fiction, Unfortunately

Probate is the court process generally required when a person with assets dies without a Last Will and Testament or some other testamentary mechanism in place that designates who should receive those assets. In Illinois, probate is lengthy – at least 14 months; costly – initial processing fees start at $850 and the average retainer is $2500; and assets are frozen for at least 6 months – so heirs cannot obtain their inheritance. So, in Illinois, unless there’s a possibility that an estate will face a protracted and costlier lawsuit, probate should be avoided. But sometimes, as much as we try, folks just don’t listen: The Other Heir Abe died without a Will, leaving his surviving spouse, Christine, and Brandy, the 3 year-old child borne of their marriage, as heirs. At the time of his death, Abe owned a small business, a home, and about $300,000 in a bank account. Christine was informed that because the bank account was the only asset with a designated beneficiary, the estate would require probate. Unbeknownst to Christine, Abe had another child, Donald, who he’d been supporting even before his marriage to Christine. Donald’s mother promised Abe that she would not confront Christine because the payments she received from Abe were 4 times as much as what she’d receive in child support. At the time of Abe’s death, Donald was 6 years of age. But then Abe died and so did all payments to Donald’s. At Abe’s death, his estate balance sheet and the probate distribution would resemble this: Estate AssetsHome, $250,000Business, $500,000Bank account, $300,000 (but this belonged to Christine)Total non-designated assets: $750,000 LiabilitiesBusiness creditors $250,000Tax Liabilities, $50,000Estate administration fees, $10,000Total Liabilities: $310,000 Distributions to HeirsChristine, 50%, $205,000Brandy, 25%, 102,500Donald, 25%, $102,500 Abe had always been concerned about Donald’s mother’s spending habits; so Abe paid many items, medical bills, clothing, and daycare directly on behalf of Donald. Now, because Donald was a minor and Abe did not plan for him in a Trust, Donald’s mother, the spendthrift, would likely be appointed Guardian of Donald’s estate with direct access to $102,500. Estate planning could have provided benefit for Donald, even without Christine and Brandy ever knowing. But… Abe didn’t plan. That DNA kit/Ancestry App Suppose that Donald was an adult and had just received results from a genealogical investigation, which illustrated that he and Abe were 99.9% son and father. He decides to search for Abe and learns that Abe just died. Christine refuses to meet with him; so Donald shows up in court… Hence, the reason why probate courts also have bailiffs. What if Donald was also a spendthrift or worse? Could he inherit?

The Most Important Estate Plan

As they always do, memories of the winter holiday season are quickly fading, as my email is flooded with messages about keeping resolutions, new lawyer marketing tactics, and the latest “ABCDEF… Trust” to tell clients about. (Estate Planning attorneys love our acronyms!) But there’s one memory I am determined to keep. During the “holidaze,” I catch-up with my reading for pleasure and one of the catch-up books I read was the mesmerizing, bittersweet, poignant, non-fiction narrative, “The Warmth of Other Suns” by Isabel Wilkerson. The reading resonated deeply as it retold stories about African Americans traversing from Jim Crow South to the subtle but damning discrimination of the North and West. Particularly, being just 1 generation removed from the Great Migration’s heroes and heroines who found themselves settling in Chicago, I was, like many readers, warmed when I could say my Aunt lived on the same street as Ida Mae. Reading Ms. Wilkerson’s work took me simultaneously far from and close to my practice. (And I was supposed to be on vacation!) Almost inhaling every page, grateful for not having to respond to emails, I hung my head in sympathy for George who, but for misdirected anger and lack of self-discipline, would have achieved so much more. I knew a George. And I nodded, indeed, as I travelled through the book with Dr. Foster, who ventured from the community spreading the fact that “yes, we can” to communities that dare us to try. Indeed, he understood that we, African American professionals, must not turn our backs but must reach forward to serve our community regardless of the economic gap that exists between us and our community family. Indeed, we must reach back and forward with deliberate and sometimes, an unnerving strive for perfection, even though individuals in our own community may not believe we are as skillful as those of other cultures. We hold our heads high, reaching back and marching forward because, in fact, we may be more skilled and knowledgeable because we had to (and often, still do) work twice as hard, under twice the constraints, to pay twice the costs, to receive half the pay, and when you work that hard, you learn a lot more than the average above-average student. And at the end of the holiday break, I returned to my email flood, packages of supplies, impossible calendar, and a myriad of phone messages but with a renewed and refreshed understanding about my law practice. Indeed, a legally sound financial foundation and distribution scheme is important; and equally important is the “this is how we got here and why and how some of us didn’t and why we must also never forget their journey” legacy. Much in estate planning and wealth-building is written about the elimination of family wealth by the third generation. But, just because something happened in the past, doesn’t mean it must occur again. More importantly, estate planning isn\’t just about helping gazillionaires save on taxes. Consider that children and, therefore, families often benefit from the musculature that is strengthened when elders share the trials and tribulations and exemplify the fortitude that propels the family forward. They learn lessons of perseverance, delayed gratification, and respect for self and others; they grow to enjoy working for work itself and not just for the compensation; and they become community leaders and “unsung heroes” because of this almost impervious integrity breathed into them by their parents and grandparents. They learn compassion and empathy. I often smile as our estate planning world buzzes so about how to assist families who no longer need estate tax planning as a component of their estate plans. What to do? What to do? As an African American, female, estate planning attorney, I’ve known what to do for a while: help people legally forward on their most important legacy – the family journey, the who, the how, and the why of “the dream.”

Love Knows No Discrimination… aka Marriage Equality Snakes Pt 3

In the springing steps of new love, newlyweddedness, and newborns, we become absorbed with, like my spouse likes to say, the “bubble and squeak” of it all. And as the bubbles grow fewer and the squeakiness turns to creakiness in the golden and platinum years, we start to plan our farewells and what that should look like in honor of our loving relationships. That planning is sometimes truncated by accelerated medical challenges but more often than not, the planning is executed without much challenge. Loved ones are able to celebrate the dearly departed in dignity and honor and friends and family join in the celebration and do what they can to console and uplift the grieving. That is, this is the farewell achievable for couples who resemble couples of 40 years ago. For LGBTQ couples, who are even lawfully married, post Obergefell, planning farewells is often not that easy. The heartbreaking story of Jack Zawadski and Bob Huskey illuminates this additional post-Obergefell challenge: Jack and Bob were a loving couple of more than half a century. Upon retirement, they moved from Colorado to Mississippi and were married in 2015, shortly after the Obergefell ruling. Before moving to Picayune, Mississippi, Bob was diagnosed with a cardiac condition that worsened to the point that, ultimately, during the last few years of his life, Jack became his caregiver. A year after marrying, the couple acknowledged that Bob’s death was imminent. He was eventually placed in a nursing home near the couple’s community in Picayune. So Jack could focus on his last days with Bob, John, Bob’s nephew and dear friend of the couple, took on the responsibility of searching for a funeral home that could provide services in Picayune. Services in their community meant Bob’s body would not have to be transferred far and the couple’s friends and family could focus on helping each other through the grieving period. Searching online, John found the Brewer Funeral Homes. He contacted the Funeral Home and entered into a verbal agreement with the owners, Ted and Henrietta Brewer, for their services. The parties agreed to price, logistics of signing the paperwork, transportation of the body, and disposition of remains. The Brewers told John that they just needed the nursing home to contact them when Bob died and everything would be properly handled. The funeral home’s paperwork required the signature of next of kin. Bob died and Jack signed the paperwork as surviving spouse. When the Brewers received the paperwork indicating Jack was next of kin as surviving spouse, that they would be servicing a gay couple, they absolutely refused to provide the agreed upon services. John eventually found services 90 miles away. However, Bob’s body had to be moved from the nursing home before that service was available, so another funeral home was required to be involved to “hold” the body. Furthermore, because everything was last minute and far away, friends from Picayune couldn’t attend the services. Needless to say, this is not what Jack and Bob had wanted. So Jack and John sued the funeral home, alleging Intentional Infliction of Emotional Distress, Negligent Infliction of Emotional Distress, Breach of Contract, and Negligent Misrepresentation. Unfortunately, Jack died in December of 2017 and a petition was filed to substitute John as a plaintiff. Then Masterpiece Cakeshop was decided… However, another case was decided a few days after Masterpiece Cakeshop that may have truncated its reach and another legislative attempt to undermine the rights of LGBTQ families was recently thwarted. So, more to come. For now, we hope that people realize that estate planning isn’t just about getting valid instruments in order, especially if your family doesn’t resemble the other 80% of American families. This is the third part of a series, Marriage Equality Snakes, examining jurisprudence that undermines the rights of LGBTQ couples to marry and have families. Part 1 ~ Part 2

Properly Caring for Great Grannies

One of my most cherished childhood memories is of my great-grandmother sitting on her single, long braid, in her rocking chair, as I patted her hand. She would quietly rock in the sun room of my grandmother’s home, her soft brown eyes staring out the window. She never said a word, which was fine with me. I was told that at one point during her life’s journey, she just stopped talking. Since my baby sister had just been born, I appreciated the solace of quiet and not speaking. So Great Granny and I would just sit in silence together and let the sun warm our faces until… I walked into the sun room one day and she was not there. Gone. Forever. In heaven. Recalling that memory from an estate planning attorney’s perspective helps me realize how very fortunate our family was. Great Granny was only mentally incapacitated, and her incapacity did not present itself in aggressive or belligerent behavior. Equally important was the fact that our family had all the resources needed to care for Great Granny 24-7. Many families who regularly reach out to our office are not so fortunate: Since those years long ago, our country has experienced economic peaks and valleys and the State of Illinois has entered an economic abyss. Thus, if an older parent becomes incapacitated today, in Illinois, and the family has limited means, the parent and, indirectly, the family will likely confront difficult circumstances, at best, unless a plan consisting of comprehensive Advanced Directives, at the very least, is in place. Often, as parents age without a plan, children will download and prepare Powers of Attorney for healthcare or finance but these documents rarely provide the protections needed to establish the kind of care aging loved ones require, especially those who may be confronting incapacity. Additionally, the way mental incapacity presents may preclude loved ones from taking the most important initial step – obtaining a mental health assessment from a doctor. So, if anyone wonders why estate planning is so critical, think of it in the following ways. Comprehensive plans, established before sundowning, prevent loved ones from: (1) starting fatal home fires; (2) causing family poverty; and (3) causing themselves and the family unnecessary trauma of other sorts. In other words, proper planning protects parents, families, and grandchildren’s cherished memories.

It’s Quite a Taxing Season…for Trusts

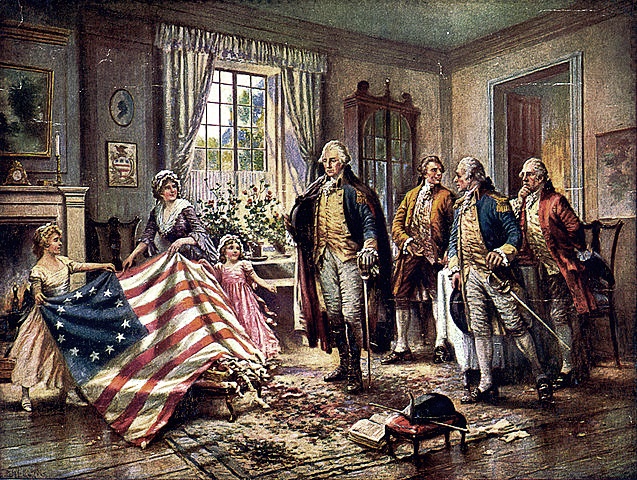

Everybody probably knows by now that in December, the Tax Cuts and Jobs Act (\”Tax Act”) was signed into law. Significant changes were made to the tax code, benefiting almost all United States citizens for at least one year and at least 1% of United States citizens for at least 7 years. In addition to the significant changes affecting individuals, the Tax Act also resulted in significant changes with respect to trust income. Before the Tax Act was signed, trust income that did not exceed $12,400 was not taxed by the Federal government. Trust income that did exceed $12,400 was taxed at the highest marginal rate, which was 39.6% in 2017. Now, with the Tax Act, the threshold has disappeared, meaning that all trust income not distributed in the year in which it was accrued is taxed at the highest marginal rate, which is now 37%. But before we get our knickers twisted, let’s parse this out a bit: Does this tax apply to all trusts? Good question. Generally, revocable living trusts are named such because the Grantor or Settlor – the person creating the trust – can change the trust whenever they want or even revoke the whole thing. Since the Grantor has this right, the assets in the trust, including all income, are considered to belong to the Grantor. So, because the assets and income belong to the Grantor, the income is generally taxed via the Grantor’s income tax return, the 1040, not an estate tax return, i.e., a 1041. Example 1 John Ross retained the firm, Hamilton & Associates to establish a revocable living trust for John, leaving his wife, Betsy, everything he owns upon his death; if Betsy dies before John, the assets will go to his nephew. John owns a house in Pennsylvania, life insurance from Lloyd’s of London, and a 49% share in Betsy’s flag-making business (Betsy’s Flags), which generates about $1,000 a year in income. After the JR Revocable Living Trust is established, John’s home is transferred to the trust because he doesn’t want Betsy to go through probate and, for some reason, he also transferred his 49% interest in Betsy’s Flags to the trust. However, the JR Revocable Living Trust is revocable and all assets still belong to John as Grantor and Trustee, so the trust pays no income tax because John pays the taxes … to the King. Example 2 John unfortunately dies while in service to his country. Upon his death, the JR Revocable Living Trust becomes irrevocable; it can’t be changed. And Betsy decides to leave John’s 49% interest in Betsy’s Flags in the trust and resigns as Trustee, letting Hamilton & Associates act as Trustee. The business is booming because several rogues, who were well acquainted with John, decided to start a war with the King and ordered a ton of flags from Betsy as a symbol of unity. So she’s quite happy with her 51% and really doesn\’t have time to administer the trust. John’s trust is now a “non-Grantor” trust because the Grantor is dead and the trust owns the assets. So any income generated by the 49% of Betsy’s Flags may be subject to the King’s income tax. Revocable Living Trust Tax 2017 2018 Income $1,000 $1,000 Federal Income Tax -0- -0- Irrevocable Trust Tax 2017 2018 Income $1,000 $1,000 Federal Income Tax -0- $ 370 Of course, one may distribute the income before the end of the year and deduct the payment from the trust’s tax return. However, scenarios exist where such distributions are neither desired nor advisable. Then what? Make sure your estate planning attorney, accountant, and financial advisor know and respect each other. Does this apply to all income? Another good question. One of the changes that the Tax Act also heralded in was a deduction for income earned by certain small businesses. Thus, the income generated by the 49% of Betsy’s Flags may actually be $296.00 instead of $370.00. What do you mean by certain small businesses? That’s a question for another article. So stay tuned…

The Supercalifragilisticexpialidocious Codicil

There we were sitting in Wills and Trusts and the prof used the phrase, “the power of the codicil.” I was struck. Why? No idea. To this day, I still love the phrase and still have no idea why. Similar to a child’s love of the phraseology of “supercalifragilisticexpialidocious.” Thus, in honor of the almighty Codicil and National Estate Planning Awareness Week, I thought it a good idea to unpack “the power of the codicil.” A Codicil (“kah-duh-sill”) is the mechanism used to change a Last Will and Testament. Consider the following scenario: A very long time ago, Molly, an independent and progressive young woman for her time, had a Last Will and Testament prepared. She was married and owned a couple of properties. Her Will left everything to her spouse and since she and her spouse had no children, Molly named her best friend, Florence,as a contingent beneficiary (or more precisely, legatee). Unfortunately, Molly and her spouse divorced and to celebrate her divorce, Molly decided to take a cruise from New York to England. Her best friend became ill and so had to stay home. During the oceanic voyage, the ship sank but Molly survived and Molly vowed to change her Will as soon as she returned home. [SIDEBAR – Had Molly died, the law would have prevented her ex-spouse from inheriting but instead of her best friend inheriting her fortune, it would have gone to her no-good nephew, Fred.] Molly’s Will was very precise and long for the day – more than 10 pages. Still, all she wanted to change were the legatees; she didn’t need a completely new Will. So… enter the Codicil. Molly’s attorney prepared 2 pages, explaining and stipulating the changes – Florence received everything and if Florence predeceased Molly, then her fortune went to the Jane Addams Hull House. Molly and 2 witnesses signed and dated the codicil and voila! All was right with the world. Her will was validly changed. Molly remarried decades ago but is now a contented widow in her twilight years with great-grandchildren. About 20 years ago one particularly geeky grandchild convinced Molly to invest in \”some contraption called \”the Google\”,” this other stock called \”Apple,\” and \”a silly online store called \”Amazon\” of all things.\” Molly\’s fortune exploded so she thought it would be a good time to change her estate plan. She intends to ensure her descendants are well-cared for and give to social justice and environmental causes. Her former lawyer has since retired, so she met with her grandchild’s lawyer and mentioned the power of the Codicil. The lawyer smiled and advised that, given her good fortune and fruitful life, an entirely new Will in addition to other planning mechanisms are in order. Molly understood and the asked if the lawyer accepted Bitcoin as payment. One may ask can a Codicil be considered a Will? For example, what if the Will was lost but the Codicil was located and, for some reason, restated everything in the Will. Because the Codicil must be prepared and signed with the same formalities as a valid Will, this Codicil would likely be considered just that – a valid Last Will and Testament. Another interesting question that occasionally pops up is what if a Testator just scratched out or added someone\’s name to the margin of the Will – what effect would those actions have on the Will? Would that deletion or addition be valid? No. Those actions are not valid unless done so contemporaneously during the signing of the Will. If done so afterward, without the formalities, the person who was scratched out will still inherit and the person added won\’t inherit a thing. After a Will has been signed, in Illinois, for those changes to be valid, one would have to execute a supercalifragilisticCodicil.

A Mother\’s Love Doesn\’t Include Dad\’s New Wife

When a spouse dies, leaving behind a surviving spouse, children, and considerable assets, the surviving spouse should tread carefully with respect to estate planning instruments governing those assets. The 2016 Illinois Appellate case, Gwinn v. Gwinn, is a good example of this premise. Background Facts Ken Gwinn, Sr. and Betty were married with 4 children. In 2002, Betty established a trust, providing for Ken and their children. If Betty predeceased Ken, he was the designated Trustee, which meant that he had a fiduciary duty to abide by the terms of the trust. In 2009, Betty died. Her estate consisted of approximately $600,000 in liquid assets, a mortgage-free home in Illinois valued at approximately $750,000, and farm property. The terms of the trust gave Ken as much of the trust income as he wanted and a discretionary, albeit limited, amount of the trust principal. Upon Ken\’s death, the remaining trust assets were to be divided equally among the children. Two years after Betty’s death, Ken married Maria. After marrying Maria, Ken withdrew $475,000 from the trust to buy a home in Colorado for him and Maria. The Colorado home was titled solely in Maria\’s name and, thus, represented a gift from Ken Sr.’s late wife’s trust to his new wife. Needless to say, the kids were not pleased. So 3 of the 4 children filed a lawsuit against their father claiming breach of trust and breach of fiduciary duty because this gift was “extraordinary” (a legal term of art for gifts that are beyond the scope of intent) and went beyond trust terms. The lower court ruled in favor of the father and the children appealed. Appellate Court Analysis and Findings The Appellate Court agreed with the children, in finding that the trust was established for their benefit in addition to their father’s benefit. However, the Court also asserted that their father was the intended primary beneficiary during his lifetime and, as trustee, had broad discretion over distributing gifts from the trust to himself as beneficiary. Nevertheless, that discretion was not absolute. After considering the cardinal rule of the “intent of the testator or settlor,” specific limiting language in the trust, relevant case law, and persuasive legal treatises, the Court ruled that the discretion of gifting from the trust was limited to Betty’s descendants. Clearly, Maria was not Betty’s descendant. Additionally, even if Ken tried to cloak the gift to Maria in his own beneficiary status, the law precluded him, in his capacity as trustee, from increasing any beneficiary’s gift, including his own. The Illinois home was sufficient; taking $475,000 from the $600,000 corpus was deemed an “extraordinary gift.” The Court, therefore, found that the nearly half-million-dollar gift from Betty’s trust to Maria was not Betty’s intent (ya think?!) and, thus, Ken breached the trust terms. In breaching Betty’s trust terms, he also breached his fiduciary duty to all of the beneficiaries. This year, if your Valentine’s Day gift requires retitling, think twice, just in case.

The Other 1%*

In the beginning of my career as an estate planner, like many Americans, I was constantly bombarded with news about the “one-percenters” – Americans who were the wealthiest of our population. With respect to estate planning, these folks had all kinds of complex trusts – GRATs, SLATs, DAPTs, CRATs, pick your trust acronym – to suit their particular needs. The one-percenters have so much wealth that in addition to lack of anxiety over financial matters, future generations of their families generally share this liberating lack of anxiety. Because our community beat the drum so loudly in an effort to assist the one-percenters in preserving their wealth, when asked what I did for a living invariably, upon hearing the response, someone would say: “Oh, you help the one-percenters; that’s not me. I’ll call you when I get there.” Yet, as an estate administrator, I also know that those who rejected the notion of needing planning help because they weren’t a one-percenter were gravely (pun intended) mistaken. Folks in the 99% category are adversely affected in a much greater proportion by loss of wealth or earning potential than the one-percenters who experience loss of wealth. On a dramatic scale, a one-percenter who loses significant wealth may go from a McMansion to a bungalow; a 99%r may go from a bungalow to a homeless shelter. I witness it nearly every time I step into probate court. Consider this example: Ben owns thousands of acres that includes a successful dairy farm, a few oil wells, a couple of streams, and farmland that produces various grains. Ben’s family has not had any financial worries in more than a century; so, yes, they’re in the one-percenters. Several years ago, Ben assumed running the family “business” from his mother and when he did so, he spent about $100,000 in estate, retirement, and business planning fees. He now spends a nominal fraction of that annually between the 3. Ben’s plan safeguards the land and income it produces, and the initial fee structure represented less than 1% of the value of his family’s wealth. Now, consider your own wealth or your family’s wealth, whether you’re at the beginning, middle, or end of your “peak” wealth accumulation period. Next, consider your health. If you were to become seriously ill, is your earning potential, current capacity, or nest egg protected? Just like Ben, the one-percenter, you too, can use less than one-percent of your wealth or earning potential to protect what you have earned or your capacity; you can safeguard you and your loved ones and even future generations with just 1% of your family\’s annual earnings. After the popularity whirling about the one-percenters cooled, we started hearing a lot about “leaning in.” I recommend we zoom in. Focusing on the one-percenters while fun is also futile; instead, focus on the other one-percent – the 1% of you that can 100% help your family. *Credit for the title goes to my dear colleague, Stephen L. Hoffman.

A Nod to Philosophers and Poets

“Change is the only constant in life.” – Heraclitus This year, 2016, will likely be determined by historians as one of the most politically chaotic in the history of the West. First, there was Brexit; then there was USAmerexit. And regardless of where you stand on either outcome, two things are certain, both: (1) were unfathomably unpredictable; and (2) represented a fundamental recognition of opinion divergence in the representative countries. Whether the diverging opinions are based largely in fact or fake news is debatable, but that the world has and will continue to change is not. So…what to do? To paraphrase the world-renowned mater poet, Maya Angelou: If you don’t like something, then change it; if you can’t change it, then change how you respond to it. Yet, often, people do nothing; they simply accept the change in quiet, unnecessary resignation. As an attorney, it is my duty to consider the pending political climate and respond accordingly by recommending pragmatic planning for changes to current policy that will affect our clients. Yet, changing political climates do not change how we always approach planning for our clients and the question we always consider: What if? Nothing is guaranteed, not good health, not good fortune, nothing except death. So, what if a loved one, who owns a nice home and has a good retirement plan, is diagnosed with a serious, long-term illness that may result in death or permanent disability? What if this kind of emotional, potentially life-changing shift occurs? Your loved one can: Fight the diagnosis aggressively, using all resources at their disposal. Doing so may work, in which case the diagnosis will change. Doing so may not work, but the fight may be a necessary catharsis or expression. Accept the diagnosis and do nothing, which will likely result in long-term and serious anguish for their immediate loved ones and squander precious resources – theirs and yours. Change the way they plan to spend retirement, by establishing a care plan and an estate plan, which will result in long-term peace and benefit for all. Most importantly, providing them with the highest quality of life possible under the circumstances. Our office has witnessed all 3 of the above scenarios and cannot emphasize how unnecessary the heartbreak – or family feuds – that inertia in cases such as the above is. The term \’chaos\’ comes from the Greek word \’kaos\’, which meant a void or an abyss; now it means utter disorder. Presuming Heraclitus’ was correct and that change is the only constant, just because we cannot predict what the change will be and the consequential effects, does not mean we cannot appropriately adjust our attitudes, plan for those effects, and avoid chaos, whether in the form of an abyss or utter disorder. Thank you, Maya Angelou and Heraclitus.

Dead Clients Do Talk

The legal doctrine of “attorney-client privilege” has become a well-known phrase in the general public\’s lexicon. What the general public does not know is that the “privilege” generally lasts past death. Additionally, what is not understood, even by some attorneys is that the attorney-client privilege is called a “privilege” because the rule is actually an exception to our overarching duty to disclose facts to opposing counsel during disputes. Further unknown to the general public and most attorneys who do not practice in probate or estate administration is the exception to this exception: the “testamentary exception.” A case decided earlier this year, Eizenga v. Unity Christian School of Fulton, Illinois, involved a trust dispute and clarifies this rule and its exceptions for Illinois courts and attorneys. FACTS Walter Westendorf (Westendorf) established trust in 1997, which he amended 7 times before dying in 2013. Dale A. Eizenga (Eizenga) was designated as successor trustee when the trust was initially prepared and executed. In fact, Eizenga, in their capacity as successor trustee, was nearly the only relevant constant during the 16 years after the initial trust was prepared. In 2006, with the trust’s 3d amendment, Attorney Russell Holesinger (Holesinger) became a trustee and Unity Christian School of Fulton, Illinois (School), of which Holesinger also allegedly represented (read potential conflict of Interest), became 1 of 3 charitable remainder beneficiaries. Four amendments later, in 2012, Holesigner became the single second successor trustee and the School became the primary trust beneficiary. Eizenga filed a complaint against Holesinger, alleging “undue influence,\” and eventually sought Holesinger’s client documents. Holesinger refused and a lower court held Holesinger in contempt, and Holesinger appealed on the grounds of attorney-client privilege and the attorney work-product doctrine. As mentioned above, the attorney-client privilege generally lasts past death but for the testamentary exception that provides that in will contests, the attorney-client privilege cannot be invoked. Ironically, in the year of Westendorf’s death, another Illinois case, DeHart v. Dehart, reiterated the testamentary exception. Holesinger argued that this case, however, didn’t involve a will but instead involved a trust. ANALYSIS The Third District Appellate Court then examined the 2010 Graham Handbook of Illinois Evidence, other case law, and treatises addressing this issue and ruled that a will contest is not the only situation where the testamentary exception can be used. Next the court considered Holesinger’s attorney work-product argument. The attorney work-product doctrine is another exception to our disclosure duties, allowing attorneys to protect trial strategies and the mental impressions and opinions used to prepare for trial and establish said strategies. Because the documents in Holesinger’s files were not “created in preparation for any impending or pending litigation,” the Court held that Holesingers documents were not protected by the attorney work-product doctrine and, thus, affirmed the contempt finding by the lower court. The rationale is that a testator or trustmaker (settlor) would want their intent followed; so, if the attorney’s work-product was the only way to settle the dispute, then that information must be made available.