Is Your Small Business Ready for FinCEN?

UPDATE: Reporting time is almost here. See this information to determine your business\’s responsibilities. On September 30, 2022, the U.S.’s Financial Crimes Enforcement Network (FinCEN) issued its final rule on Beneficial Ownership Information Reporting Requirements, mandated by the Corporate Transparency Act (CTA). The rule aims to combat money laundering and terrorism by collecting and maintaining Beneficial Ownership Information (BOI) for U.S. businesses. It addresses the use of corporate structures, such as Limited Liability Companies (LLCs) by illicit actors and aligns with international efforts to combat unlawful activities. The rule outlines reporting requirements, including who must report and the violation consequences that are costly (like $500/day!). The current U.S. framework for combating money laundering and terrorism has shortcomings, making it attractive for illicit actors to create hidden shell companies. The final rule requires new covered businesses to submit timely BOI reports to FinCEN within 90 days of establishment. Existing businesses have until January 1, 2025, to submit their initial reports. Accuracy and updated information are emphasized. Reporting companies must include specific information in their initial reports, such as legal name, trade name, address, jurisdiction of formation, and EIN or TIN. They must also provide details of each beneficial owner and company applicant, including full names, dates of birth, addresses, unique identifying numbers, and images of identification documents. Corrected and updated information must be reported later. The final rule defines a \”beneficial owner\” as an individual who exercises substantial control over the reporting company or who owns at least 25% of the company (ownership interest). Exceptions to the definition include minor children, nominees, intermediaries, custodians, agents, employees, individuals with future inheritance interests, and creditors. If no exceptions apply, beneficial owners can be identified based on substantial control and ownership interests. The rule provides indicators of substantial control and clarifies the definition. Businesses must determine if they are considered reporting companies for purposes of the final FinCEN BOI rule. Domestic reporting companies include corporations, LLCs, or entities created by filing documents with a secretary of state or similar office. Foreign reporting companies are entities formed under foreign law and registered to do business in a state or tribal jurisdiction. The rule does not add exemptions beyond the 23 specified in the CTA. Companies must also determine the extent of their reporting obligations and maintain a record of changes in company applicant information. The definition of a company applicant is limited to one or two persons. Additionally, existing companies are exempt from providing applicant information, but new companies must comply. Complying with the final rule may be challenging, because it involves analyzing multiple individuals with ownership interests and substantial control. FinCEN has not imposed limits on the number of beneficial owners to be reported to create a comprehensive database. Small businesses may benefit from legal counsel to navigate and comply with these measures. Special thanks to our Attorney Ruth Stein, for culling the research.

The Smallbiz Entity Trap

When researching what type of business entity to select, entrepreneurs often seek the most popular option – a Limited Liability Company (LLC). LLCs are popular because they don\’t require the administration that S-Corporations (S-Corps) require – filing quarterly tax returns, holding annual meetings, paying employee wages. Additionally, LLC participants, aka “members,” don\’t own the LLC property, which provides members with some liability protection. (Hence, Limited Liability Company.) LLCs can have one or more members, single-member LLCs (SMLLCs) or multiple-member LLCs, respectively. Furthermore, unless an LLC selects to be treated as an S-Corp, LLCs are treated as partnerships, where the loss or gain of profits flow through to the members. However, when approached about entity selection, while administration and tax issues are important, for start-ups, it\’s critical that liability protection is thoroughly considered. If a judgment is placed against an LLC, the judgment creditors can generally only place liens on the distributions or the LLC property. So, if an LLC member of a multiple-member LLC is sued, the judgment is placed solely against that member’s distribution, whereby the other members can receive their distributions. But, if the LLC is an SMLLC, treated as a partnership, and a judgment is entered against the distribution, then that member won\’t be able to receive their distribution (share of the profit) until they settle the judgmentd. What’s a partnership of one? A sole proprietorship. Who gets sued in sole proprietorships? The proprietor. Whose assets are subject to judgments in sole proprietorships? The proprietor\’s. Ergo, depending on the jurisdiction, S-Corps are sometimes more suitable; they provide an extra layer of liability protection. Because an S-Corp owner/employee would be treated as an employee for the S-Corp, if the S-Corp was sued, the S-Corp owner/employee, unlike an LLC manager/employee, would still be able to receive wages and, thus receive part of the profits. (Ownership shares of an S-Corp are not wages.) As mentioned above, an LLC can seek to be treated as an S-Corp, whereby the owner is also paid as an employee. But, that means that the administrative burdens that accompany S-Corp status are now also a part of the LLC. And that defeats the simplicity purpose of establishing an LLC. THE TAKEAWAY…Potential smallbiz owners should consider liability as an important factor when selecting a legal structure: Choosing the wrong entity can mean the difference between a great launch or great flop .

New Laws Approaching Fast

Summer has ended for most families with children and we thought about this and other family dynamics in our most recent newsletter. However, the summer didn\’t stop Illinois Governor Pritzker from approving several laws that will affect families and businesses in the coming months. Here\’s a few that you may find interesting: The Illinois Trust Code, effective January 1, 2020, aligns Illinois with states that have adopted or established their own version of the Uniform Trust Code. Meaning for you: As you and your family move among the states, your estate plan may not need much revision. Assault or battery of an elderly person results in a loss of inheritance, effective January 1, 2020. Meaning for you: Nothing, we hope. Recreational cannabis will be legal in Illinois, effective January 1, 2020. Meaning for you: If you will partake or endeavor commercially, remember it is still against the law, federally, Uniform Partition of Heirs Property Act, effective January 1, 2020. Meaning for you: If you inherit property with someone else as a co-tenant and y\’all can\’t get along, the property can be sold without mutual agreement. Department of Public Health Powers and Duties Law amended to allow a feasibility study for a state repository for Healthcare Powers of Attorney and other medical Advanced Directives. Meaning for you: Unclear; these are your taxpayer dollars going to a study to determine if your medical information should be held by the State. Those are the headliners that we found relevant to our clients and associates. We\’ll be providing deeper analyses of these issues and others as the laws become effective and part of our society\’s fabric.

It’s Quite a Taxing Season…for Trusts

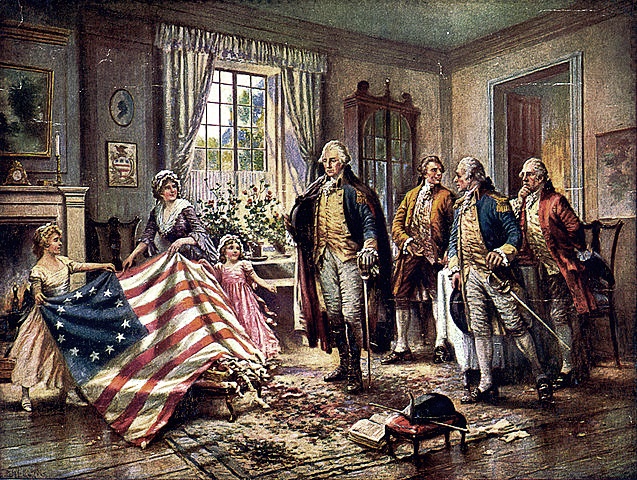

Everybody probably knows by now that in December, the Tax Cuts and Jobs Act (\”Tax Act”) was signed into law. Significant changes were made to the tax code, benefiting almost all United States citizens for at least one year and at least 1% of United States citizens for at least 7 years. In addition to the significant changes affecting individuals, the Tax Act also resulted in significant changes with respect to trust income. Before the Tax Act was signed, trust income that did not exceed $12,400 was not taxed by the Federal government. Trust income that did exceed $12,400 was taxed at the highest marginal rate, which was 39.6% in 2017. Now, with the Tax Act, the threshold has disappeared, meaning that all trust income not distributed in the year in which it was accrued is taxed at the highest marginal rate, which is now 37%. But before we get our knickers twisted, let’s parse this out a bit: Does this tax apply to all trusts? Good question. Generally, revocable living trusts are named such because the Grantor or Settlor – the person creating the trust – can change the trust whenever they want or even revoke the whole thing. Since the Grantor has this right, the assets in the trust, including all income, are considered to belong to the Grantor. So, because the assets and income belong to the Grantor, the income is generally taxed via the Grantor’s income tax return, the 1040, not an estate tax return, i.e., a 1041. Example 1 John Ross retained the firm, Hamilton & Associates to establish a revocable living trust for John, leaving his wife, Betsy, everything he owns upon his death; if Betsy dies before John, the assets will go to his nephew. John owns a house in Pennsylvania, life insurance from Lloyd’s of London, and a 49% share in Betsy’s flag-making business (Betsy’s Flags), which generates about $1,000 a year in income. After the JR Revocable Living Trust is established, John’s home is transferred to the trust because he doesn’t want Betsy to go through probate and, for some reason, he also transferred his 49% interest in Betsy’s Flags to the trust. However, the JR Revocable Living Trust is revocable and all assets still belong to John as Grantor and Trustee, so the trust pays no income tax because John pays the taxes … to the King. Example 2 John unfortunately dies while in service to his country. Upon his death, the JR Revocable Living Trust becomes irrevocable; it can’t be changed. And Betsy decides to leave John’s 49% interest in Betsy’s Flags in the trust and resigns as Trustee, letting Hamilton & Associates act as Trustee. The business is booming because several rogues, who were well acquainted with John, decided to start a war with the King and ordered a ton of flags from Betsy as a symbol of unity. So she’s quite happy with her 51% and really doesn\’t have time to administer the trust. John’s trust is now a “non-Grantor” trust because the Grantor is dead and the trust owns the assets. So any income generated by the 49% of Betsy’s Flags may be subject to the King’s income tax. Revocable Living Trust Tax 2017 2018 Income $1,000 $1,000 Federal Income Tax -0- -0- Irrevocable Trust Tax 2017 2018 Income $1,000 $1,000 Federal Income Tax -0- $ 370 Of course, one may distribute the income before the end of the year and deduct the payment from the trust’s tax return. However, scenarios exist where such distributions are neither desired nor advisable. Then what? Make sure your estate planning attorney, accountant, and financial advisor know and respect each other. Does this apply to all income? Another good question. One of the changes that the Tax Act also heralded in was a deduction for income earned by certain small businesses. Thus, the income generated by the 49% of Betsy’s Flags may actually be $296.00 instead of $370.00. What do you mean by certain small businesses? That’s a question for another article. So stay tuned…

Time to Make the Soup

Recently, our office, sent a client alert regarding IRS news that hit the estate and financial planning communities late this summer. If you or someone you know has a small business, the information below will probably be of interest. What Is Given Can Be Taken Away In August, the Internal Revenue Service (“IRS”) issued Proposed Regulations that could have a dramatic impact on estate and business succession planning by eliminating valuation discounts traditionally available to closely held businesses. Discounts are currently used to help protect a family or closely held small business from the risks of future divorce, lawsuits, or malpractice claims while maximizing the value of the underlying assets. When a Valuable Business Can\’t Be Sold: Discounts Explained Consider this example: Thomas has a $7M estate that includes a $5M family business. He gifts 40% of the business to a trust to grow the asset out of his estate. The gross value of the 40% business interest is $2M. Since a minority 40% shareholder (the trust) cannot force a sale or redemption of its interest, the non-controlling interest in the business transferred to the trust is worth less than the pro-rata fair market value of the underlying business. Thus, the value of the business interest should be reduced to reflect the difficulty of marketing the non-controlling interest. As a result, the value of the 40% business interest transferred to the trust might be appraised, net of discounts, at $1.2M. The discount has reduced the estate by $600,000. From another perspective, consider the issue if Thomas\’ children buy the business and the taxes they would have to pay for a business interest that isn\’t \”marketable\” were it not for the valuation discount. Timing Is Everything Once the Proposed Regulations eliminating or decreasing discounts are effective, which could be as early as December 31 of this year, the ability to obtain discounts might be substantially reduced or eliminated, thus curtailing wealth planning flexibility. Furthermore, as the 2016 year–end gets closer, it will become more difficult and, at some point, will become impossible to have banks and trust companies create trust accounts. If you’re unsure of what you might wish to do, you may want to take the preliminary steps as soon as possible. For example, if you don’t already have trusts that could serve as appropriate receptacles for 2016 discounted gifts, it would be wise to establish trusts immediately. You can always determine later which assets and how much to transfer. Get in the Kitchen Make that alphabet soup, i.e., contact your planning team. A collaborative effort is essential to solid, effective wealth planning. Your wealth transfer strategy team, i.e., your attorney, CPA, CFP, and insurance professional, can review strategic wealth transfer options that will maximize your benefit from discounts while still meeting other planning objectives. Projections completed by your wealth manager could be essential to confirming how much planning should be done and how. ***Disclaimer*** The Law Offices of Max Elliott advises clients on legal strategies regarding estate and wealth planning issues; we do not provide financial planning or tax planning advice. We\’re only one letter – albeit a good one – in the alphabet soup.

Your Resolution: Keep Fake Children Out of It

Recently a post went out from our office across a few social media outlets that pretty much sums it up when it comes to reasons why most folks, especially parents and smallbiz owners need a will. The post went something like: “Got kids? Get a will. Got more than one heir? Get a will. Got a high risk job? Get a will. Got the picture? If it\’s a Renoir, get a will.” The Issue: Children While we’ve written here repeatedly about how important it is for parents to have a will because of the guardianship provision, it bears repeating. Only by having a valid will can you nominate a potential guardian or potential guardians for your children. If you’re a single parent, having a valid will is all the more important. You don’t want an irresponsible parent having control over your child’s estate, which he or she will have, if you’ve followed this series and bought life insurance, or daily care if the other biological parent believes that chips and fruit punch make for a good breakfast. An alternative issue about children can be found in the converse: If you’re single and have been responsible intimately, you want to ensure that “fake children” cannot inherit from you. The issue: Multiple heirs. Wills or the potential for inheritance often results in less than happy-go-lucky family dynamics, especially if someone dies without a will and with a couple of children or a few nieces and nephews. So a will allows one to head the family feud off at the pass. You can state who will get what and when and the best part is you don’t have to say why. Frankly, that should be communicated long before the ink on the will is dry. If you’re unsure about the allocation, you can leave it to the discretion of the executor and have a “no-contest clause” inserted and then talk about it at Thanksgiving. That might provide the impetus needed for having that “conversation.” The Issue: High Risk Profession. Do you work as a carrier of jet fuel? Are you a criminal defense attorney or a divorce lawyer with walk-in offices? High-wire artist? Human rights attorney working in the hotspots, such as Afghanistan? The Issue: Art and other collectibles. People tend to put a value on everything from brown crock-pots to President Jefferson’s cravat. If you own anything that is similar to Jefferson’s cravat, the pen Clinton used when he signed DOMA, Reagan’s cowboy boots, Liberace’s cape, you need to get that or those items first appraised by a qualified appraiser. Next, you should have a will prepared that will determine how that valuable piece or collection is going to be managed, i.e., sold, handed down, donated. More than 70% of Americans don’t have a will and that percentage surely includes people who have children or who don’t plan to have children, folks with more than a few heirs who might argue over a collection of antique doohickeys. Children should be taught how to plan; one should plan appropriately for not having children; and doohickeys should also be in the plan – the estate plan that includes a will.

4 \”Must Ask\” Questions for Smallbiz Owners and Single Parents

This is the third of 4 articles in our 2013 Estate Planning Fundamentals Review series. We\’ve already covered, life insurance and healthcare powers of attorney. So moving on…to property powers of attorney. Property powers of attorney are important components of an estate plan because the documents help people plan for today as well as tomorrow. The instruments are even more important for single parents and small business owners because often the single parent or smallbiz owner is the sole keeper of the keys to the family’s or business’s financial kingdom. So if the key keeper becomes seriously ill or suffers a devastating injury, the financial kingdom could turn to ruin if a trustworthy substitute keeper isn’t ready to step in. A property power of attorney allows for designation of a substitute keeper. Consider the following: Karyn and Jonah are divorced. Karyn has sole custody of Little Caroline because Jonah was abusive; Karyn’s restraining order proved so. Karyn was an only child whose parents died a while back. She and Jonah moved to Illinois immediately following the birth of Little Caroline, who is 5 years old. By the time Little Caroline was 2, Jonah and Karyn’s relationship was over. After the divorce, Karyn bought a flower and wine boutique, which is thriving. She owns a modest home and lives well within her means. However, Karyn has recently learned that she must be undergo major surgery and will be in recovery for at least 6 weeks, 3 of which will include her being heavily medicated. Because she put so much time into her business, though she has a part-time employee, and spends all of her spare time caring for Little Caroline, she hasn’t had a lot of time to really nurture other friendships. Furthermore, Jonah not only has a violent temper but he also has an erratic employment history. So there is no way Karyn would let him near Little Caroline or her financial affairs. So some but not all of the questions Karyn should consider are: Who will care for Little Caroline while you’re in the hospital and during the first few weeks of your recovery? Do you have 6 months of emergency daily living expenses saved? If you pay your mortgage early, will you be penalized? While you are in the hospital and a bill becomes due, have you arranged for its payment and how? If a complication arises, requiring a longer hospital stay and, thus, a longer recovery period, who will tend to your personal and business affairs? If you conduct your affairs online, who will have access to your online accounts and how have you cleared this with the relevant institutions? Can your part-timer handle opening and closing the shop during your absence? How has this authority been provided and is there a back-up plan? Can the shop survive during your absence? If you have arranged for someone to manage your financial affairs, have you limited their authority and how? All parents and business owners owe a duty to their families and business stakeholders to plan. For single parents and small business owners, failing to plan creates dangerously and unnecessary high risks to family and stakeholders.

Women & Obamacare: It Hurts Not to Know

Recently, I attended a great program on women’s healthcare. The discussion included how the Affordable Care Act would affect our healthcare and the decisions we made. So please read this article and share it with all the women you know. Thank you, Affinity Community Services for hosting, Kathy Waligora of the Illinois Maternal and Child Health Coalition, the Chicago Women’s Health Center (CWHC), and Dr. Theresa Jones for sharing such valuable information. Resources to the topics are at the end of this article. Because estate planning and financial planning are closely related, health insurance is a key component to successful estate planning. Without appropriate health insurance, everything you own is at risk of loss … to a hospital bill or to long-term care. So no estate planning involving asset distribution will matter because the hospital bill or caregiving expenses will have created a gaping doughnut of an estate for you. The exponential increase of healthcare costs over the last couple of decades is one reason why fewer and fewer individuals and families considered estate planning: with little or no insurance, planning for the transfer of assets would be an exercise in futility. However, that risk for millions has been and is being mitigated by the Affordable Care Act (“ACA” or “Obamacare”). Before the ACA, 40 million Americans had no health insurance and millions of children would never be able to obtain it because of pre-existing conditions. In 2010, when the ACA passed, the number of uninsured Americans were reduced by 10%. And though the ACA has come under intense fire, by 2014, millions more of Americans and small businesses will receive 50% of credits to help offset the cost of coverage. Additionally, the cost of coverage for women will be fair. Until the ACA was passed, women were made to pay more for healthcare insurance than men and, unlike what most individuals thought, it was not because most women could become pregnant. So why were women paying more for health insurance? That’s a good question that insurance companies have yet to provide an answer for. But they won’t have to because on January 1, 2014, gender will be eliminated as a criteria for determining health insurance costs. Moreover, preventive and wellness services, especially for women, that were not available in many insurance plans will be available to women at no cost through the ACA. The critical need for these services is highlighted by the recent news about celebrity Angelina Jolie’s healthcare decisions. Included in the free preventive and wellness services mandated by the ACA are: BRCA counseling about genetic testing for women who at high risk, Anemia screening for pregnant women, Cervical cancer screening, Domestic and interpersonal violence screening and counselling, Folic acid supplements for women who could become pregnant, Osteoporosis screening for women over 60, and Well-woman visits. The ACA mandates these services included in 22 preventive services because legislators and the current administration recognizes that preventive maintenance and reformed and regulated healthcare for all Americans ultimately reduces healthcare costs across the board for our country, community, and loved ones. Another important feature of the ACA is Medicaid reform. However, states must agree to take advantage of the new Medicaid rules. If Illinois agreed to embrace the rules, it could man billions of dollars and thousands of jobs. However, the 3.8% surtax on families with household incomes of $200,000 or more has fueled the uproar mentioned earlier. This could result in these households being taxed at a marginal rate of near 45-50% and nobody likes to pay taxes. Still, Illinois Senate Bill 26 (SB 26) is pending with regard to this question. As of 5/21 the bill was passed, after several notes, to the House Committee. As I said at the top, information about our healthcare and how to use that information is too important – not just to us but also to our families – not to share, so please pay this forward and let women (and men) know that \”affordable healthcare is available to you.\” Helpful Resources Illinois Congressional Representatives, http://www.ilga.gov/house/ Health Insurance 101, http://101.communitycatalyst.org/aca_provisions/ Illinois Maternal and Child Health Coalition, http://www.ilmaternal.org/

3 E-commerce Tips for Smallbiz Owners

Today\’s article was generously contributed by Deanna Wharwood, a lifetime member of the U.S. military. Thanks, Deanna, for serving our country in more ways than one! As a consumer, when you check out of your local convenience store, you may swipe your credit card through a point-of-sale device and your gas, coffee, and donuts are paid for. What if you are the retailer and your business is online? How do you as the retailer process their credit card information? Essentially, that is the job that the payment gateway. What\’s a Payment Gateway? Payment gateways allow online merchants such as electronic store owners or auction sellers to accept credit card payments over the Internet. They authorize the cardholder’s credit, i.e, they check to ensure that the customer has enough money on their credit card to cover the charges. Then they place a hold on that amount so the buyer can’t turn around and spend that same money elsewhere before it gets transferred to the retailer’s merchant account. A Payment Gateway is NOT a Merchant AccountMany people confuse merchant accounts with payment gateways but they are not the same. Merchant account services act, for the most part, as a liaison between your business bank account and the payment gateway. When a customer orders a product from your online business their card is processed via the payment gateway. The money is then moved over to the merchant account service. The merchant account service then moves those newly captured funds to your business bank account. 3 Tips for Choosing a Payment Gateway Is it PCI-compliant? If it is compliant, then the company’s security has been audited by a third party and met the industry standards. Since payment gateways store all your customers’ credit card information, your customers’ valuable information is secure. Does it provide good customer support? Clearly good customer support is essential, especially when your account receivables are involved. You will want to be able to reach a person on the telephone when there are challenges. And, you also want to make sure that you have back-ups to your invoices. Is it compatible? Finally, it is important that the payment gateway you choose be integrated to the third-party solutions you are planning to use. That means things like store front platforms and shopping carts work with your gateway. Many payment gateways offer an array of security features, some of which will help you avoid becoming a victim of fraudulent orders! In the end, they will make your e-commerce business a less-stressful, more pleasant experience for you and your customers.

5 Reasons Why the \”Permanent\” Exemption Matters to You

Many people probably know that Congress made permanent the Federal estate tax, which is $5 million, indexed for inflation, per person and $10 million per married couple. This means that approximately 98% of Americans will not have taxable estates on their deaths with respect to the government’s estate tax. A sigh of relief for many families could be heard across the land. However, folks shouldn\’t sigh too heavily because the same matters that existed before for individuals and families were not eliminated by Congress’s act. So the following are 5 issues that have nothing to do with the federal estate tax but are still very important to protecting yourself and your family: You have children. Even families with modest-sized estates should ensure that their children are cared for according to their wishes and values if a tragedy occurs. Minor and disabled children are of primary concern. I’ve written before that without a will that nominates a guardian, minor or disabled children may be placed with someone a parent would consider less than ideal. Beyond that, consider retirement proceeds. If a minor or even young adult child is the beneficiary on a retirement account, depending on the language of that account, Uncle Sam may still take a large bite or equally troubling, a relatively young adult may come into a large sum of money in one fell swoop. You aren\’t married BUT you are in a loving committed relationship with someone. So that means your significant other or partner, while being able to benefit from your lifetime exemption, cannot benefit from portability. Also, the same issue with respect to retirement proceeds as mentioned above also apply in this scenario. If your unmarried in the eyes of the federal or state government but you and your partner have a child, just bring the issues of number one right on down. You are a professional or small business (smallbiz) owner. Unfortunately, we Americans are a litigious bunch. If we believe we have suffered an injury related to professional services, e.g., doctor, lawyer, dentist, or a small business, then many of us have no problem pursuing litigation that will cost much more than the malpractice insurance covers. Estate taxes have little or nothing to do with covering your assets from multimillion dollar litigation. You have income producing assets. The federal government and many state governments tax beneficiaries on 2 levels: estate and income. If your daughter\’s trust has income producing assets, such as the 3-flat apartment building you gave her, then there is a likelihood that the trust will have to pay income tax. How much depends on how well your team works to protect you. Still, like number 3, this has nothing to do with estate taxes. You live in a \”decoupled\” state. Some states are \”coupled\” with the Federal estate tax regime, meaning their state\’s lifetime estate tax exemption is identical to the Federal government\’s. However 28 states are decoupled, and most of those states, unlike Illinois, have a significantly lower estate tax exemption amount. So that means that while estate tax may not be due to Uncle Sam, it may be due to Uncle Quinn – Illinois\’ governor, for example. Estate taxes were a primary focus of estate planning because no one likes paying taxes. Well, estate taxes are no longer a primary focus and those other issues still need to be considered, just like they did before December 31, 2012.