As Baby Boomers start retiring, thoughts of mortality and legacy planning begin to dance in their heads. While most boomers don’t have taxable estates…for now…the future is still a question mark for many.

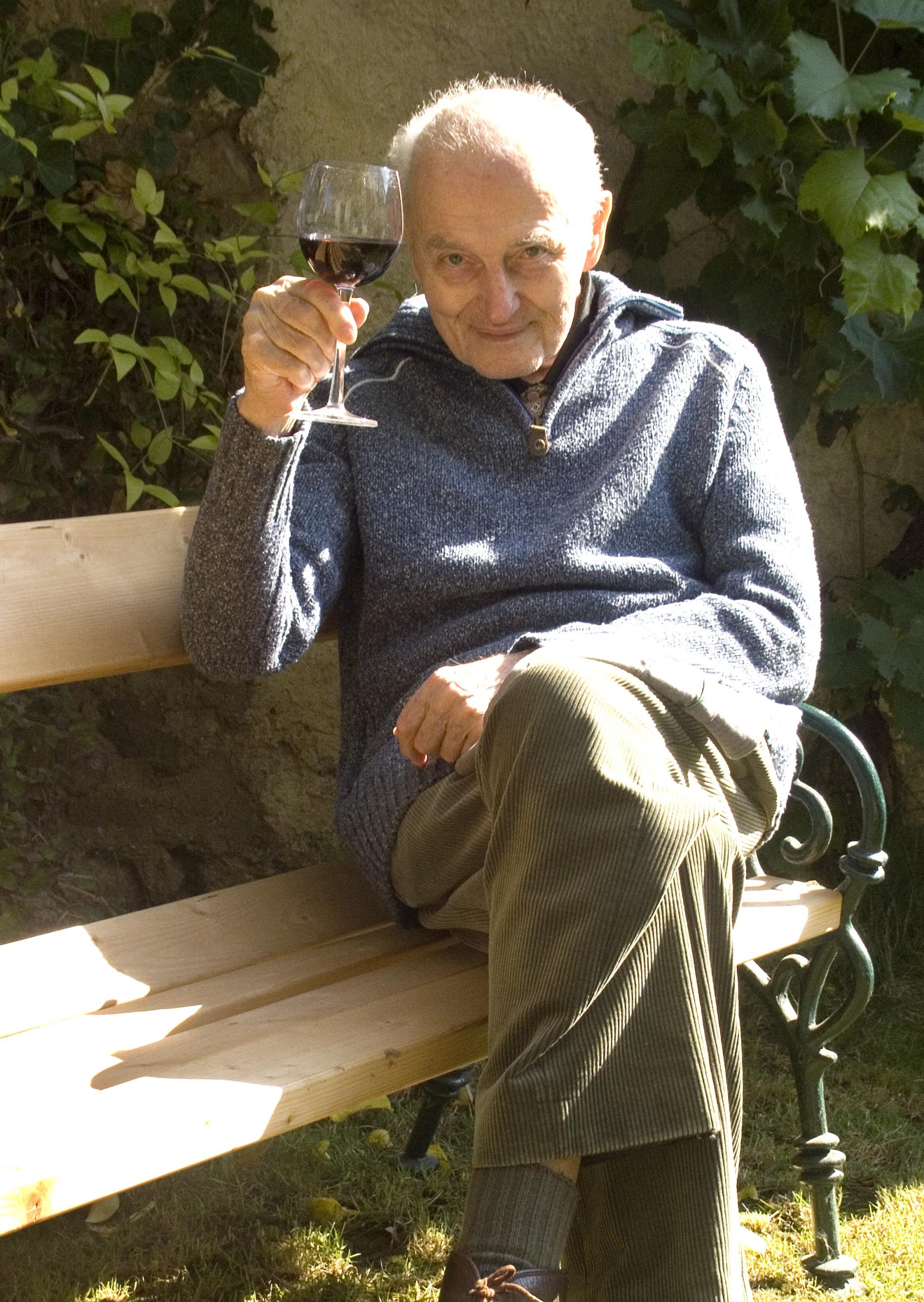

While enjoying retirement – golf course, cruises, mountain climbing, museum walks, wine tasting, and theatre galas – plans should be made for a time when the retirement funds must be transferred to someone else. It is critical to know how to transfer retirement proceeds properly so the distributions won’t be literally and figuratively taxing:

Claire and Cliff are in their mid 60’s. They’ve a modest estate – home valued at about $250K with most of its equity remaining, life insurance, and retirement benefits at about $2 million. Half of the retirement proceeds is in a 401(k), 25% is in an IRA, and 25% is in an annuity.

They also have 2 kids: Lenny and Lisa. Lisa’s a starving artist, who is barely in the 15% tax bracket but who also has a vivacious and smart teenager. Lenny is 10 years older than Lisa and a savvy professional about to move into the highest tax bracket and has no intention of marrying or ever having children.

Claire and Cliff want to distribute their estate to Lisa and Lenny equally and have been told to give the retirement proceeds to Lenny and Lisa outright.

Before doing that, however, I would ask them to consider the following in a simultaneous death situation, where Claire and Cliff went down with the Titanic III:

- An outright gift from a 401(k) or a traditional IRA will be taxed and if the beneficiary is over 59 ½, the 10% penalty may also apply. For Lenny, who’s Mr. Money Bags, that doesn’t present too much of a problem, though no one wants to pay taxes. For Lisa, that would be a boon indeed. But an outright distribution to Lisa would yield less than what she would receive were the proceeds titled to a trust because of income tax consequences. Pick the fruit too young and the wine will be bitter; too old and you may taste too much oak.

- Claire and Cliff could have the proceeds placed in a trust for Lenny and Lisa. Here, part of Lisa’s benefit would be driven by Lenny’s life expectancy because he is the oldest, which would provide her with fewer years of income. Additionally, Lenny and Lisa must be sure to withdraw at least as much as the minimum required distribution annually or face a hefty penalty. Different varietals require different soils.

- In a qualified (retirement) annuity, the entire amount of the contract must be withdrawn over the 5-year period following Claire and Cliff’s death. Again, okay for Lenny, but not so okay for Lisa. Tax consequences also apply to this issue. Cabernets are as good as zinfandels; it’s the consumer’s tolerance that is key.

Just like no 2 families are alike, no 2 children are alike. So make sure that your children know how to make decisions about the different types of distributions they can choose, after you enjoy your fruits. That way, the remaining fruit will, in fact, go to your children and not the community jelly jar.