Updated May 27, 2023

Amidst Polar Vortex 1 of January 2014, a group of wonderful folks and yours truly sat around a warm office, invited by IntraSpectrum , discussing LGBTQ relationship rights. I introduced them to my series Love & the Law, here, as briefly as I could and we had a great time.

So, really, what does all of this mean? Well, my (former) rockstar intern, Emily Welter, boiled down my hefty remarks into a few poignant and fabulous images and take-aways:

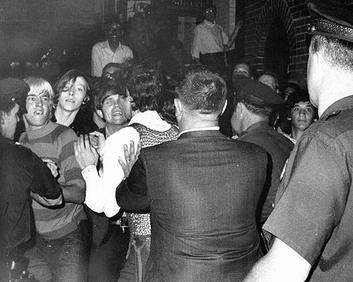

The equality fight then

Joseph Ambrosini of the New York Daily News

The equality fight later…

and…

DOMA …

and …

WINDSOR

and …

SCOTUS…

By Quinn Dombrowski from Berkeley, USA – Mommy, Mama and Baby GeorgieUploaded by Anastasiarasputin, CC BY-SA 2.0, https://commons.wikimedia.org/w/index.php?curid=27239587

and POTUS…

OH MY!

Much like Dorothy and her gang, our Nation’s lawmakers followed a harrowing yellow brick road to marriage equality for over 50 years. We have come a long way from the 1966 case of Loving v. Virginia and we made positive strides towards that “Emerald City” of equal love.

Below are 8 key points to know about the legal changes that took place in 2013 – aka the “Watershed Year” – which have affected Estate Planning for today’s LGBT couples:

- Several States passed marriage equality laws;

- SCOTUS (“Supreme Court of the United States”) ruled in favor of lesbian surviving spouse, Edith Windsor;

- SCOTUS ordered the IRS to treat legally married same-sex couples the same as straight married couples;

- The IRS mandated equal treatment of legally married LGBTQ couples for all tax treatment;

- The IRS called employers to issue FICA refunds to legally married LGBTQ couples;

- The IRS called on other agencies to comply with the new IRS rules;

- USCIS removed its barrier to legally married LGBTQ immigrant spouses; AND, finally

- Illinois passed same sex marriage(!);

- SCOTUS ruled in favor of marriage equality in Obergefell v. Hodges; and

- President Joe Biden signed the Respect for Marriage Act, repealing DOMA and helping ensure marriage equality for all U.S. persons.