Most people incorrectly assume that if someone has a Last Will and Testament, then the Will captures everything the decedent owns and probate is not required. If this were correct, the lives of probate lawyers would be a lot easier.

Often people pass away with a Will or a Trust not accounting for a legatee (someone who inherits under a Will) or beneficiary that might predecease them or not referencing a bank account here or there or thinking that they have “time” and will deal with the real property “later” but “later” never comes.

And the result is usually very unhappy executors, successor trustees, and beneficiaries.

When a loved one dies intestate, that means they died without having designated beneficiaries to all of their estate. And what is an estate for inheritance purposes? An estate is everything the decedent owned outright, with no other person, at the time of their death.

Occasionally, minors inherit estates.

Sidebar: A minor is a person who has not reached adulthood or “age of majority.”

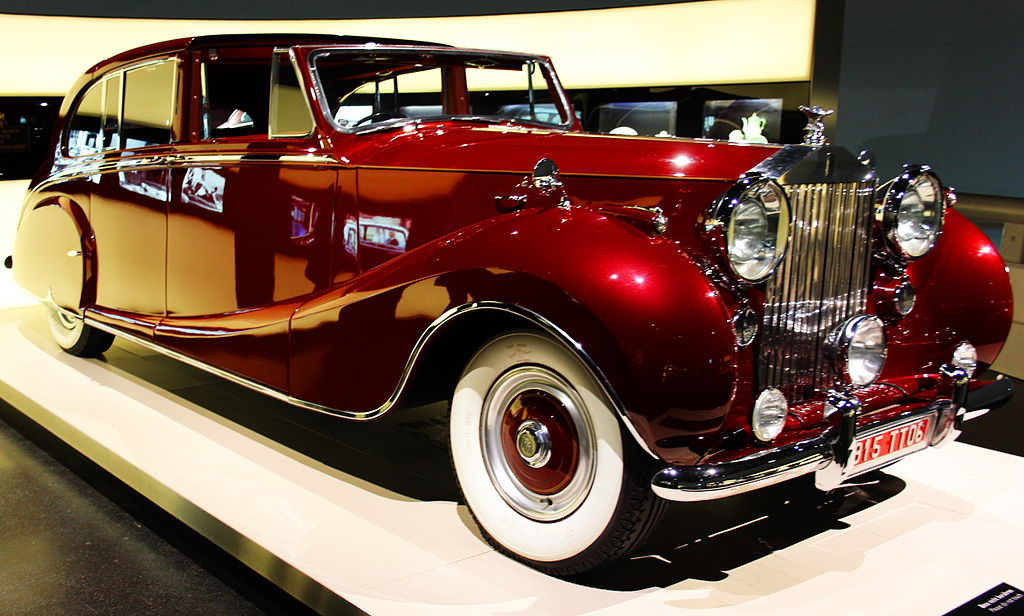

Usien, CC BY-SA 3.0 <https://creativecommons.org/licenses/by-sa/3.0>, via Wikimedia Commons

When a minor inherits from an intestate estate, guardianship or conservatorship is usually required. And to make matters even more complicated, jurisdictions and government agencies disagree on the precise definition of minor. For example, some states specifically define a minor as a person who is 16 years of age or older, other states, such as Illinois, specifically define a minor as someone who hasn’t reached age 18…but a state agency has determined that a minor is someone who hasn’t reached 21.

Next, let’s say the child’s parent died with a 401k that has no designated beneficiary. According to Illinois law, the child is an adult and would be an heir able to inherit the 401k, provided no other issues would impede their ability to do so. And no guardianship would be needed.

Sidebar: I am not suggesting an 18 year-old inheriting $50,000 without guidance is a good thing. Oh contraire…

And, according to the most updated SECURE Act provisions, which governs inheritance of retirement assets, an 18-year-old child is a minor for purposes of inheritance.

Furthermore, since the SECURE Act is Federal Law, with respect to the inheritance and federal law supersedes state law, does that also mean that the 18-year-old child will need a guardian? State law says no, but the decedent would likely be rolling over in their grave I am sure. Because…this hasn’t been tested in the courts yet.

And if the decedent had a surviving spouse, what can that spouse do? Say, “No, surviving child, I know the state court says you can take the lump sum of $50,000 now, but please don’t.”

This scenario occurs more often than one imagines.

Oh how I do wish our government agencies talked with each other…

In the interim, the surviving spouse should probably make sure the 18-year-old has a very good driving instructor and lots of car insurance…